USD/JPY has decreased a little in the short term, but the outlook is still bullish for the weeks to come. The current decrease was expected after the failure to take out the near-term resistance levels.

The pair has rallied after the breakout from the Falling Wedge pattern, the minor correction could bring another long opportunity. The Yen has taken the lead of the short term as the Nikkei stock index has slipped lower in the short term. The risk-on sentiment could push the stock market higher, USD/JPY could climb higher if JP225 and the USDX continue to increase.

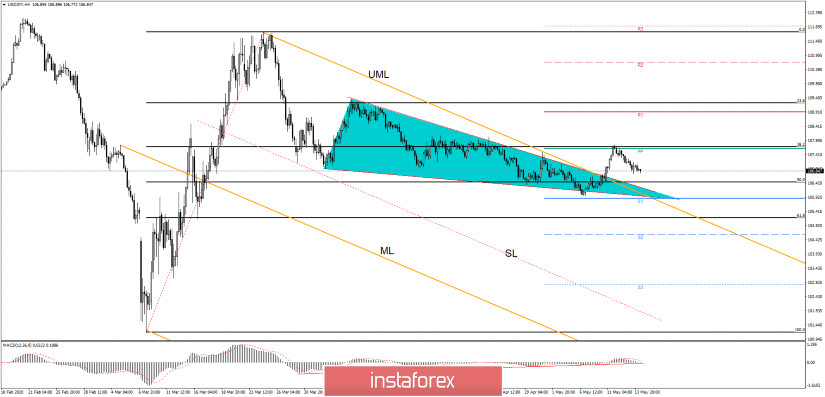

USD/JPY has found strong resistance at the 38.2% retracement level and at the Pivot Point (107.62) level, the outlook is bullish as long as the price is traded above the 50% level, above the upper median line (UML), and above the S1 (105.87) level.

The minor decrease could bring a great buying opportunity, so you could search for long signals on lower timeframes. The near-term support levels retest and rejection will signal a bullish momentum, however, the failure to reach these levels will suggest an increase as well.

I believe that only a valid breakdown below the S1 (105.87) will invalidate a major increase and will confirm a selling opportunity. Technically, USD/JPY is somehow expected to increase towards the 111.71 high after the failure to reach the median line (ML) of the orange descending pitchfork.

- USD/JPY TRADING TIPS

Maybe the USD/JPY decrease was natural after the aggressive breakout above the upper median line (UML) and above the Falling Wedge resistance. The pair is bullish above the 50% (106.44) - S1 (105.87) area, the retest of this zone will bring a very good buying opportunity. As I've said earlier, the major upside target is seen at the 111.71 level, right below the R3 (111.92) level.

A failure to reach and retest the support area will signal a bullish movement sooner, in this case, you should wait for an increase and a valid breakout above the PP (107.62) and above the 32.8% level before going long on USD/JPY. The breakout and stabilization above the near-term static resistance levels will offer us a perfect buying signal. The R1 (108.90) and the R2 (110.65) levels could be used as potential upside targets as well.

You can sell USD/JPY if the price drops below the S1 (105.87) level, if it makes another lower low. USD/JPY could drop if the USDX and JP225 decrease.