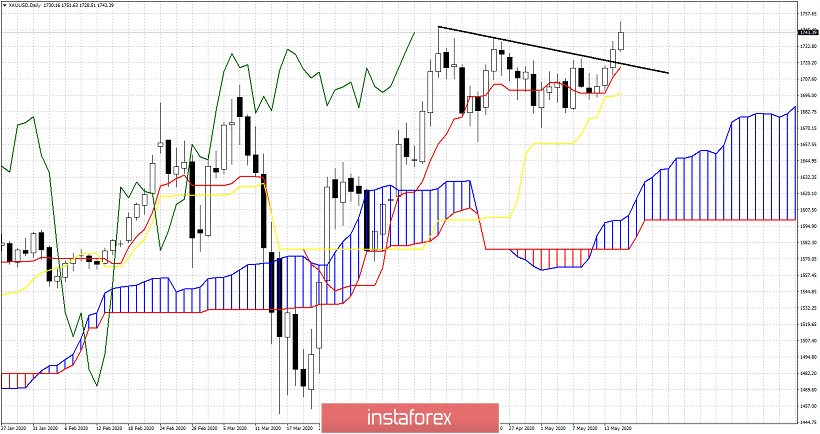

Gold price is making new 2020 highs as we expected from our previous posts. Gold price has first managed to recapture $1,700 which was a crucial pivot point and many battles were given there. Once support was solid, bulls broke above the lower highs trend line resistance.

Gold price remains in a bullish trend. We noted in our previous analysis that a break above $1,720 would bring price to new 2020 highs. Now $24 higher we are above the resistance trend line and still above both the tenkan-sen and the kijun-sen. Support is found at $1,716 and next at $1,694. The latter is the most important one. Gold price could continue higher towards $1,770-80 area before making at least a short-term top.

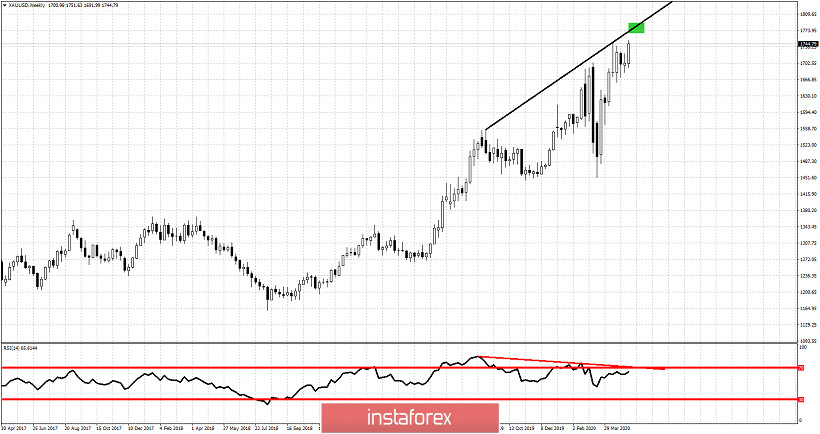

Green rectangle - target

Gold price is making new highs. The weekly RSI is not. What does this mean? A reversal could come over the coming weeks. This reversal will be confirmed on a break below $1,694. As I explained in our latest posts, although I'm bearish Gold around $1,740-50, this time is different, because the break out pattern points to higher levels. $1,770-80 is very possible targets. Yes another bearish divergence may come, but I prefer to wait and look for short positions near that target green area.