EUR/USD has increased a little, but the selling pressure is still high as the USDX is about to break strong resistance. The Dollar Index further advance will force EUR/USD to drop further and to reach fresh new lows.

The pair is trapped within an extended sideways movement, but I really hope that we'll have a clear direction soon. EUR/USD is trading near the range support, so a breakdown is favored if the USDX resumes the upside movement. Powell's speech about the COVID-19 crisis and economic outlook has lifted the price, but the increase could be only a temporary one.

- EUR/USD Range Breakout!

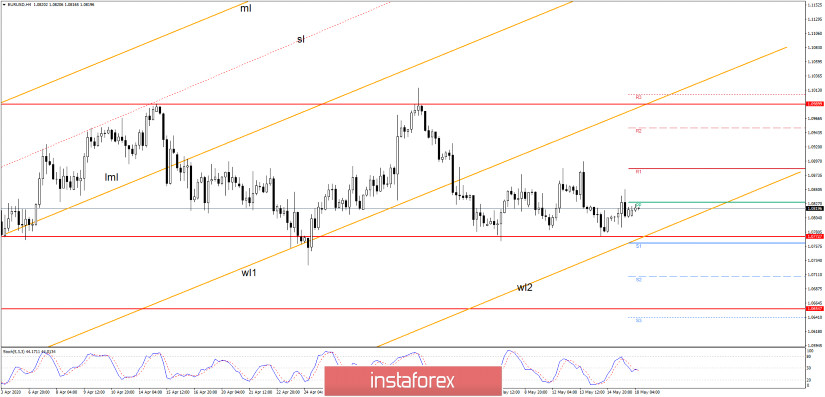

EUR/USD is moving in a range between 1.0990 and 1.0777 levels, it was rejected by the static support, but it has failed to come back towards the pattern's resistance, signaling selling pressure.

It has come back to retest the weekly Pivot Point (1.0829) after another failure to approach and reach the second warning line (wl2) of the orange ascending pitchfork. Technically, the failure to reach the warning line (wl2) has confirmed a minor bullish momentum, but personally, I believe that EUR/USD will reach this potential downside target/dynamic support soon.

A valid breakdown below the warning line (wl2) is favored when it is reached by EUR/USD price. So, a valid breakdown below the second warning line (wl2) will most likely bring a breakdown below the 1.0777 static support and below the S1 (1.0762) level and will confirm a further drop.

In the short term, a breakout above the PP (1.0829) level will validate an increase towards the R1 (1.0884) level.

- EUR/USD TRADING TIPS

Long - EUR/USD could register a broader increase if the price registers a valid breakout above the 1.0990 static resistance, after a valid breakout from this extended sideways movement, the first target will be somewhere at 1.1200 - 1.1215 area. However, the pair could increase in the short term as well, so a valid breakout above the R1 (1.0884) level and above the 1.0896 high will validate a further increase.

Another false breakdown with a great separation below the 1.0777 static support will offer a great buying opportunity as well, the target will be at the 1.0990 level.

Short - a further drop will be confirmed after a valid breakdown below the second warning line (wl2), below the 1.0777 static support and below the weekly S1 (1.0762) level. This potential downside breakout will suggest a drop at least till the 1.0654 level and towards the 1.0640.