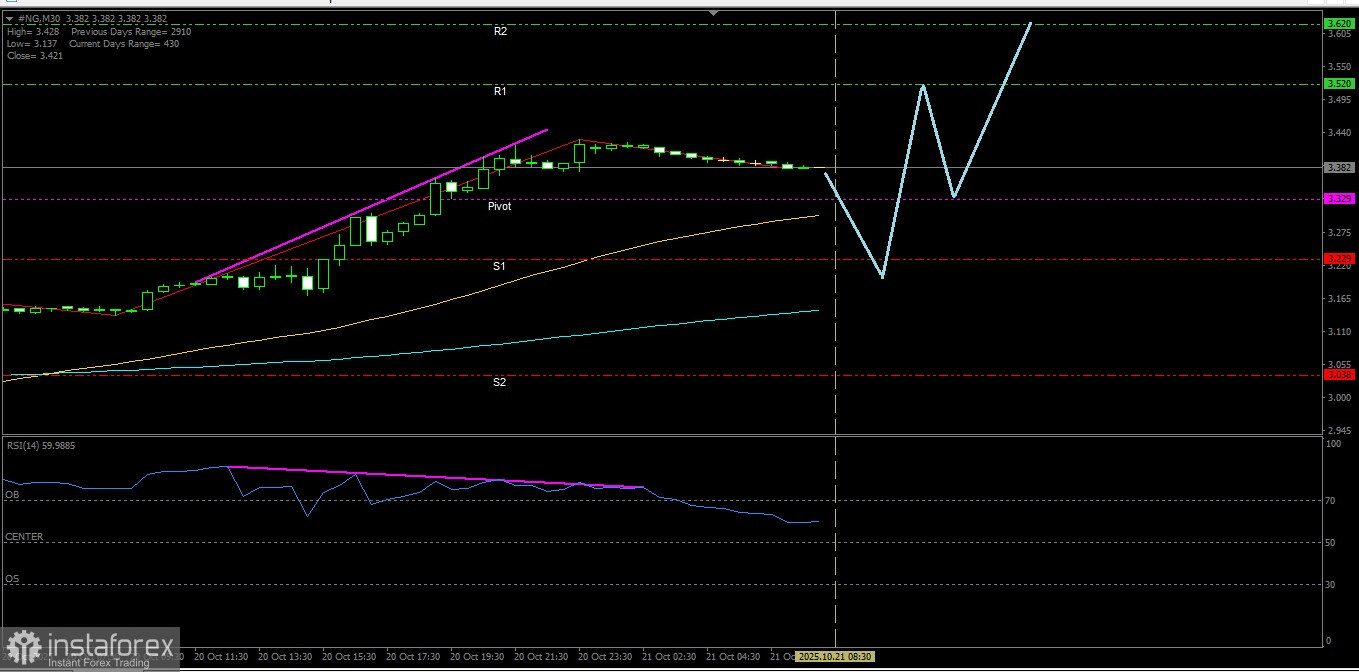

[Natural Gas] – [Tuesday, October 21, 2025]

Although there is the potential for a weakening correction with the appearance of Bearish Divergence in the RSI, the condition of the EMA(50) & EMA(200) which are Golden Crosses provides an opportunity to continue strengthening.

Key Levels:

1. Resistance. 2 : 3.620

2. Resistance. 1 : 3.520

3. Pivot : 3.329

4. Support. 1 : 3.229

5. Support. 2 : 3.038

Tactical Scenario:

Positive Reaction Zone: If #NG strengthens and breaks through and closes above 3.520, it may attempt to test 3.620.

Momentum Extension Bias: If 3.620 is broken and closes above, Natural Gas could continue to 3.811.

Invalidation Level / Bias Revision:

The upside bias weakens if Natural Gas declines and breaks and closes below 3.038.

Technical Summary:

EMA(50) : 3.299

EMA(200): 3.143

RSI(14) : 59.60 + Bearish Divergent

Economic News Release Agenda:

There are no economic data releases expected today during the U.S. trading session.