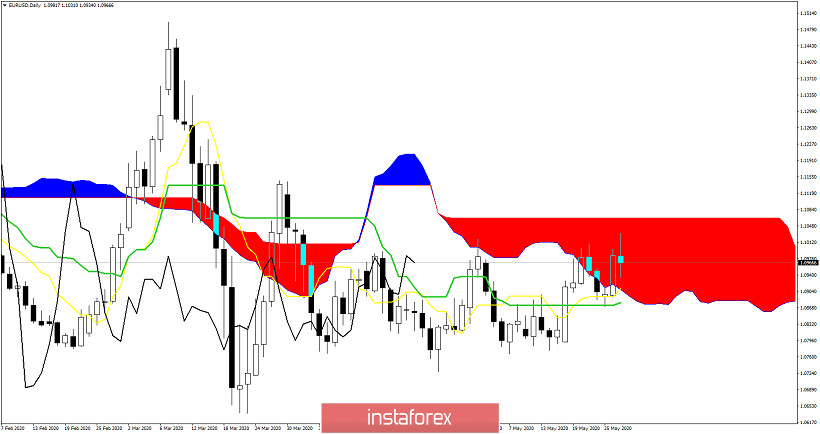

EURUSD has made another try to break above the key Daily horizontal and Ichimoku cloud resistance at 1.10-1.1020 area but has failed. Price remains inside the Kumo (cloud) and we continue to consider trend neutral.

Red line -long-term resistance trend line

EURUSD got rejected at the green rectangle resistance area today and is reversing. This could mean nothing and just be an initial pull back. It is important for the short-term price to stay above 1.0870. Breaking below 1.0870 will increase the importance of the rejection. Horizontal support we find next around 1.08. The market is mostly ranging for the last couple of weeks so it is preferred either to stay neutral or sell near resistance levels and buy near support levels. Stops should be placed on the trading range extremes and if price breaks any of them, we follow the trend.