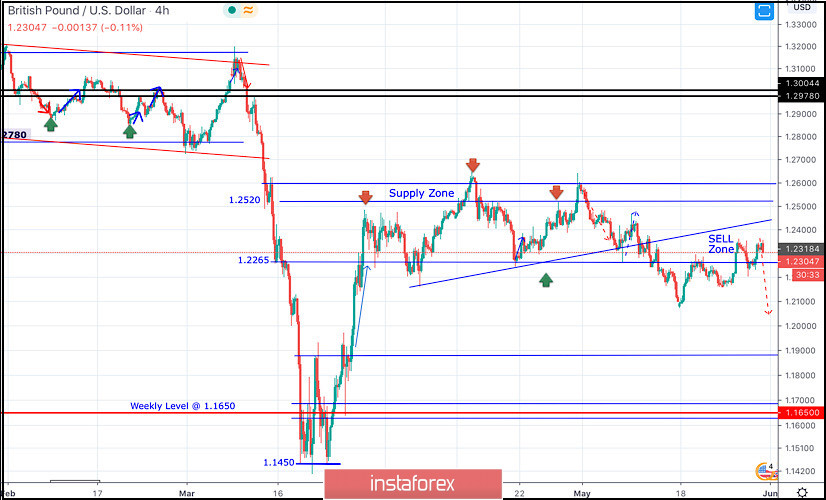

Recently, Bullish persistence above 1.2265 has enhanced another bullish movement up to the price levels of 1.2520-1.2590 where significant bearish rejection as well as a quick bearish decline were previously demonstrated (In the period between 14th - 21 April).

Recently, Atypical Bearish Head & Shoulders reversal pattern is in progress. The GBP/USD pair was recently demonstrating the Right Shoulder of the pattern.

Hence, Bearish persistence below 1.2265 (Reversal Pattern Neckline) was needed to confirm the pattern. Thus, enhance another bearish movement towards 1.2100, 1.2000 then 1.1920.

Two Weeks ago, the price zone of 1.2300-1.2280 corresponded to a short-term uptrend as well as a recently established demand zone where a low-risk short-term BUY trade could be taken.

However, the recently demonstrated Lower High around 1.2440 invalidated the suggested short-term bullish trade.

Shortly After, the price zone of 1.2300-1.2280 failed to provide enough bullish support for the pair.

Recent transient bearish breakdown below 1.2265 should have been taken into consideration as it has temporarily confirmed the previously-mentioned reversal-top pattern.

Hence, further bearish decline was expected to be enabled towards 1.2020 as a projection target for the reversal pattern.

Currently, the price zone of 1.2300 - 1.2350 (Backside of the broken Uptrend) stands as a recently-established SUPPLY-Zone to offer bearish rejection and a valid SELL Entry for the pair in the short-term.

Trade recommendations :

Intraday traders can still consider the current bullish pullback towards the price zone of 1.2300-1.2350 as a valid SELL Entry.

T/P level to be located around 1.2150, 1.2100 and 1.2000 while S/L should be placed above 1.2380.