Overview:

- Pair: EUR/USD.

- Trend: uptrend.

- News: Demonstrations and riots in the United States of America. VS. Coronavirus (COVID-19).

According to the last event of demonstrations and riots in the United States of America. Moreover, Corona's (Coronavirus (COVID-19)) problems still persist strongly and cause massive material losses. So, So, the closest possibility that the US dollar will know great weakness this week.

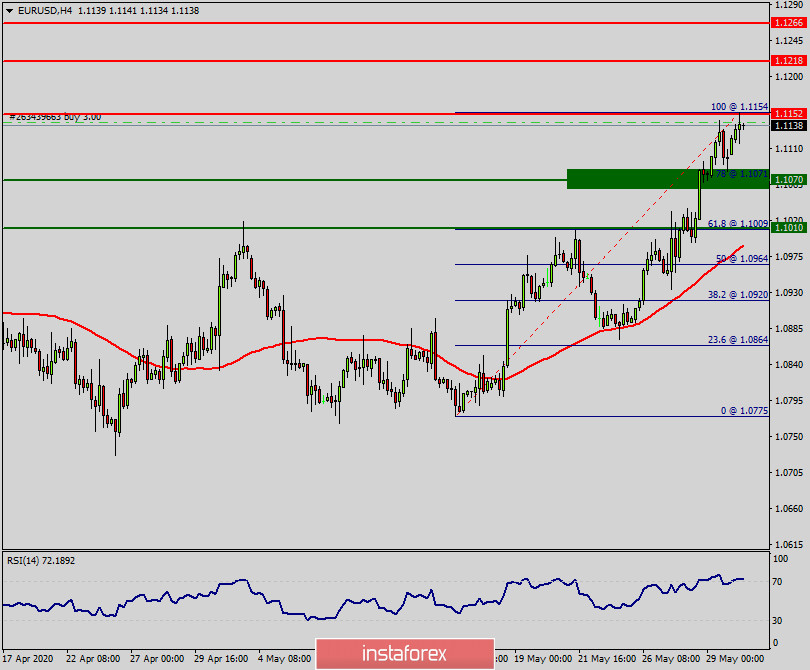

The EUR/USD pair has known the breaking of resistance levels of (1.1010 and 1.1070), until the situation has stabilized to set around the spot of 1.1100.

The EUR/USD pair strength has accelerated sharply after the conclusive break above the levels of 1.1010 and 1.1070 since last week. Hence, the support levels will be placed at 1.1010 and 1.1070 respectively in coming days.

Some positive news about the Euro currency that lies in the European central bank's policy-setting governing council will likely increase the size of its €760 billion pandemic emergency purchase program (we heard that last week also).

Our future outlook:

The EUR/USD pair will continue to move in an uptrend from the level of 1.1070.

The major support is seen at 1.1070, while immediate resistance is found at 1.1152. Besides, it should be noted that the resistance coincides with the ratio of 100% Fibonacci (double top).

Today, we guess that the pair will be traded higher in the early session and try to reach the first resistance at the level of 1.1152. The bias is neutral in the nearest term probably with a little bullish bias testing 1.1152 area which needs to be clearly broken to the upside to keep the bullish scenario strong.

A clear break above that area (1.1152 ) could lead the price to the neutral zone in the nearest term testing 1.1218. Thus, we confirm the bullish scenario.

Therefore, the price is expected to reach a high once again. It is rather gainful to buy at 1.1070 with the targets at 1.1152 and 1.1218. Consequently, it is recommended to place take profit at the price of 1.1218 as the first target today.

On the contrary, stop loss should be placed at the price of 1.009 (below the daily support). The bullish outlook remains the same as long as the RSI indicator is pointing to the upside on the four-hour chart.