The head of SNB, speaking at a panel discussion organized by UBS, said that the bank has the space for maneuver in both instruments, the bank is ready to reduce rates when it will be necessary.

So as to avoid excessive growth of the franc exchange rate, the Bank of Swiss Confederation carries out exchange rate intervention and the deposit rate has long been kept at 0.75%. The coronavirus pandemic influenced the demand of the Swiss franc, it has grown significantly, that is why the bank activity in the foreign exchange market has increased.

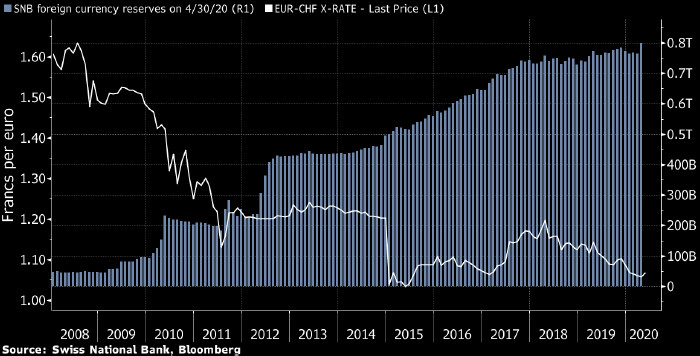

Dynamics of the euro-franc and balance of SNB

Thomas Jordan noted that it is hard to say what period of time Swiss francs will be in great demand. In his opinion, before to make any actions it is important to think carefully about all the pros and cons. And only if there are more advantages, the SNB will continue to boost its balance.