USD/JPY is trading in the green and maintains a bullish outlook, the extended sideways movement could give us a great chance to catch the next bullish momentum. The optimism and the Nikkei's rally could weaken the Japanese Yen, but the dollar needs a bullish spark from the USDX to be able to dominate the market and to drag the USD/JPY pair higher.

Technically, USD/JPY is bullish, but we still need a confirmation as the price is trapped within an extended range. There's a chance that the pair will continue to move in range if the dollar index will drop further.

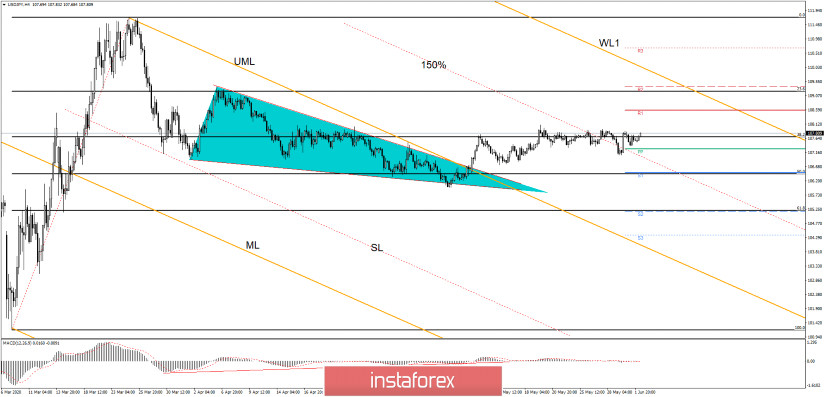

USD/JPY has decreased a little after another failure to stabilize above the 38.2% level, but it has failed to stabilize below the 150% Fibonacci line and below the PP (107.28), signaling a potential increase.

Another higher high, a jump above the 108.08 level, will announce a further increase in the short term, the next targets are represented by the R1 (108.57), the 23.6% level, the R2 (109.38), and by the first warning line (WL1) of the former descending orange pitchfork.

A further increase could be invalidated by a drop below the PP (107.28) level, a lower low will bring a short signal.

- USD/JPY Trading Tips

USD/JPY could approach and reach the R1 (108.57), the 23.6% level, and the warning line (WL1) if the price manages to increase and close above the 108.08 high. The pair is bullish as long as it stays above the 38.2% retracement level and above the PP (107.28) level.

I've said in my previous analyses, that USD/JPY is somehow expected to increase towards the 111.71 high after the pair has failed to approach and reach the median line (ML) of the descending pitchfork. Such an important increase will be confirmed after a valid breakout above the warning line (WL1).

A significant drop will be validated after a potential valid breakdown below the Pivot Point (107.28) and after USD/JPY makes another lower low, to drop and close below the 107.07 low. In this case scenario, 50% and 61.8% levels could be used as targets.