Gold has found a tough resistance and now is trading in the red again, but the current drop could be only a temporary one if the near-term support levels holds. The yellow metal price has rallied in the short term from the $1,700 level as the global risk is high.

Gold is trading at $1,720. Technically, it has shown some overbought signals last weeks, but we need a confirmation that the yellow metal will develop a significant corrective phase. The price seems very heavy right now, but the outlook is bullish as long as the price is trading above the $1,700 psychological level.

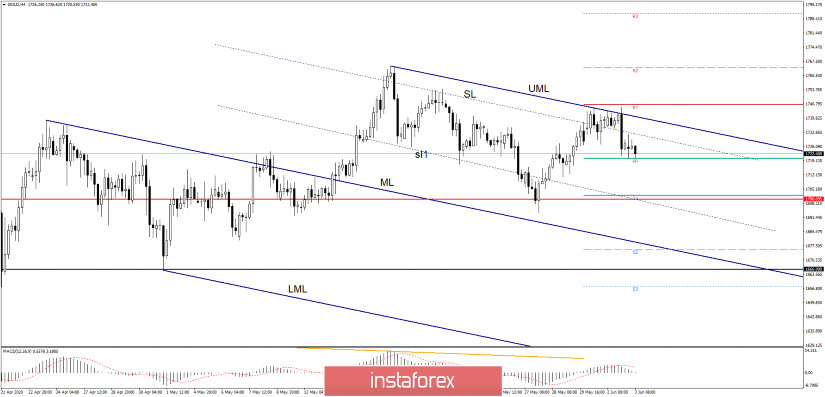

The gold price was rejected by the upper median line (UML) of the minor dark blue descending pitchfork and now is pressuring the Pivot Point ($1,720) level. It could drop deeper if it closes and stabilizes below the weekly PP, the S1 ($1,702), and the $1,700 levels could be used as near-term targets.

A further increase will be confirmed by a valid breakout above the upper median line (UML), such a potential breakout will signal a breakout above the R1 ($1,746) level, signaling a significant increase towards $1,800 psychological level.

- Gold Trading Tips

Gold will register a broader drop if it closes and stabilizes below the $1,700 level and if it makes another lower low, to drop below the $1,693 level. The median line (ML) of the descending pitchfork, the $1,666, $1,555, and the $1,484 levels represent major downside targets as well as downside obstacles.

The yellow metal could resume the major uptrend if the current drop is only temporary. Another rejection or a false breakdown below $1,700 could bring a buying opportunity. Still, we may have a great long opportunity after a valid breakout above the upper median line (UML) and above the R1 ($1,746). The R2 ($1,764), R3 ($1,790), and the $1,800 levels are seen as targets.