Overview:

Due to the upcoming problems of the Coronavirus disease (COVID-19), the trading working hours of many major financial centers was changed, which affected the trading of the GBP/USD pair notably, because the market was not stable and the trend was not clear.

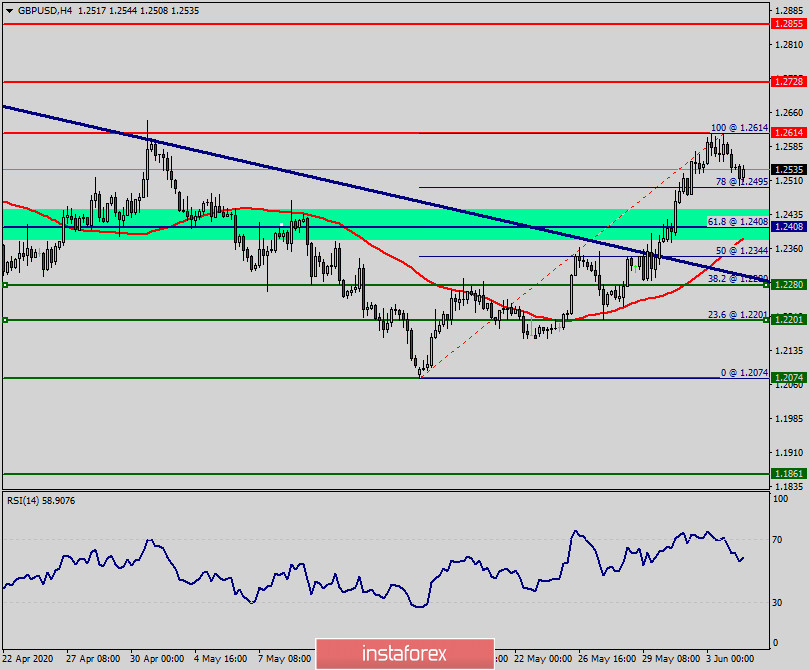

Consequently, the market will probably start showing the signs of tight sideways range on June 04, 2020. Thus, the GBP/USD pair will be restricted by the levels of 1.2408 and 1.2614. So it is of the foresight to pay attention to this area. Therefore, try to buy at a lower price around the weekly pivot point at the price of 1.2408 with a first target of 1.2614.

If the pair is able to break the weekly resistance 1 at the 1.2614 level, it will climb towards the next objective of 1.2728. Please check out the market volatility before investing, because the sight price may have already been reached and scenarios might have become invalidated. Equally important, the RSI and the moving average (100) are still calling for an uptrend.

Therefore, the market indicates a bullish opportunity at the level of 1.2408 in the H4 chart. Remember that always buyers are bidding at a lower price to buy. Therefore, it will be too gainful to buy long above the level of 1.2408 and look for further upside with 1.2614 and 1.2728 targets. It should also be reminded that stop loss must never exceed the maximum exposure amounts. Thus, stop loss should be placed at the 1.2344 level today.