Overview:

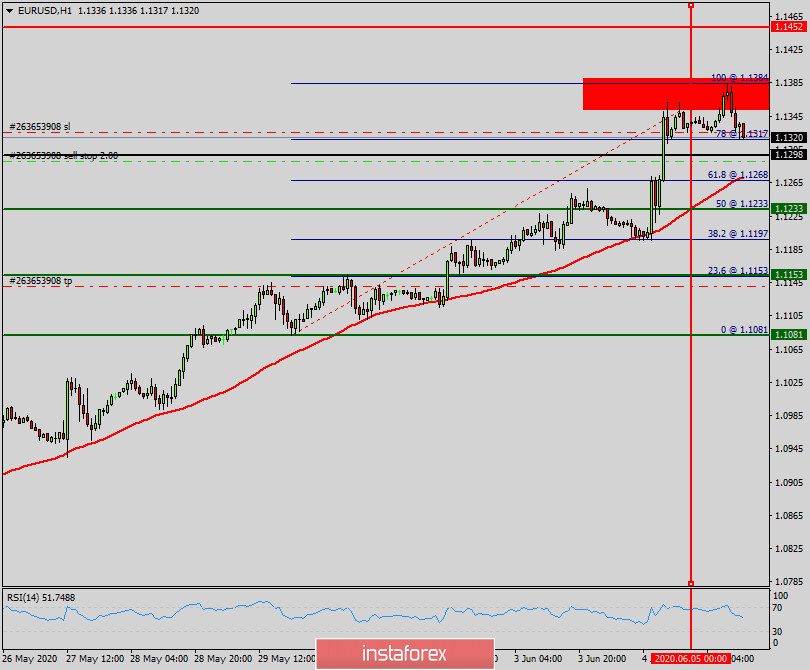

- The EUR/USD pair faces strong resistances at the levels of 1.1384 because The EUR/USD pair knows saturation at the area of 1.1384-1.3050 on June 05, 2020.

- So, the strong resistance has been already formed at the levels of 1.1384- and 1.3050 for that the pair is likely to try to approach it in order to test it again.

- However, if the pair fails to pass through the level of 1.1384, the market will indicate a bearish opportunity below the new strong resistance level of 1.1384.

- Moreover, the RSI starts signaling a downward trend.

- Thus, the market is indicating a bearish opportunity below 1.1384 so it will be good to sell at the zone of 1.1384 or/and 1.1290 with the first target of 1.1233. It will also call for a downtrend in order to continue towards 1.1153. The daily strong support is seen at 1.1131.

- However, the stop loss should always be taken into account, for that it will be reasonable to set your stop loss at the level of 1.1452.

Technical levels

- Resistance 3: 1.1567

- Resistance 2: 1.1465

- Resistance 1: 1.1400

- Pivot Point: 1.1298

- Support 1: 1.1233

- Support 2: 1.1131

- Support 3: 1.1066

Forecast/signal:

- Sell at the spot of 1.1400 to 1.1290 with the targets of 1.1233 and 1.1153. At the same time, if a breakout happens at the support levels of 1.1400 and 1.1452, then this scenario may be invalidated. But in overall, we still prefer the bullish scenario.

- Warning: Please check out the market volatility before investing, because the sight price may have already been reached and scenarios might have become invalidated.