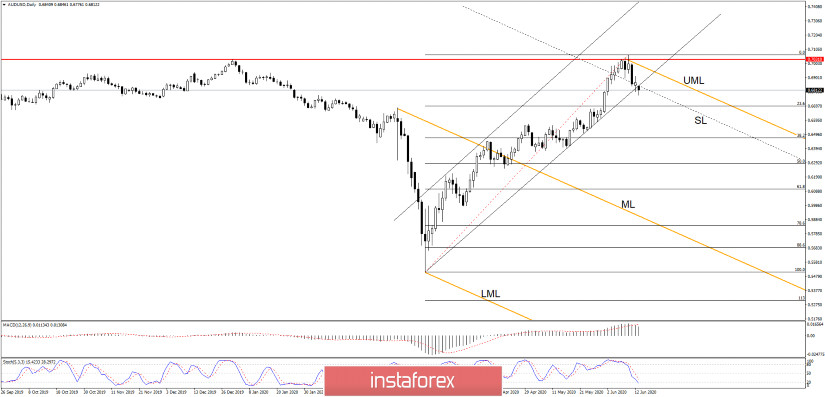

I believe that the USDX's further growth in the short term could confirm the USD dominance. So the AUD/USD pair could drop deeper. It is still premature to talk about a larger drop, but if the pair makes a valid breakdown from the up channel, AUD/USD could drop at least to the 0.6450 level.

AUD/USD decreased aggressively on Thursday confirming a short-term decrease after a false breakout above the 0.7031 level. It slipped below the uptrend line, up channel's support, and below the inside sliding line (SL) of the orange descending pitchfork, so a validated breakdown could signal a further drop.

A valid breakdown from the up channel will suggest a potential drop towards the 38.2% retracement level, at 0.6468. AUD/USD will be under some bearish pressure as long as it stays within the descending pitchfork's body, below the UML.

- AUD/USD Trading Tips

We could have a short opportunity if AUD/USD closes and stabilizes below the 0.6799 level. The first downside target will be at the 23.6% level, around 0.6695. As I've said above, AUD/USD could drop deeper if it stays within the descending pitchfork's body and most important, below the inside sliding line (SL).

Last Wednesday's false breakout above the upper median line (UML) signaled a corrective phase in the short term on the daily chart.

Right now we cannot say anithing about a buying opportunity. We'll have one after the pair finishes the current corrective phase or if AUD/USD makes another higher high to jump and close above the 0.7063 level.