USD/JPY is trading in the green according to the H4 chart, Tuesday's pin bar has announced that the bearish movement could be complete and that the pair could rebound and recover after the last drop.

The pair is almost to get out from a minor down channel, an upside valid breakout will suggest buying as well. USD/JPY could jump higher if the USDX and Nikkei resume the short term growth.

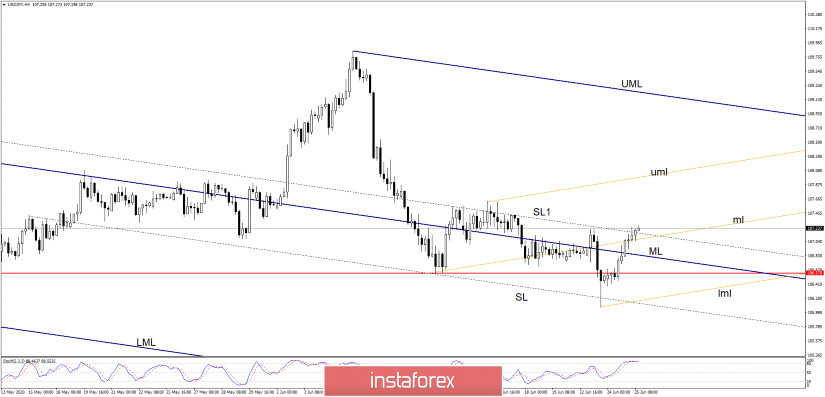

USD/JPY has made only a false breakdown below the 106.57 and below the inside sliding line (SL) of the descending pitchfork, the pin bar signaled a potential reversal. The price has managed to jump above the upside sliding line (SL) and above the median line (ml) of the minor ascending pitchfork, a valid breakout here will validate further gains.

The currency pair was trapped between the sliding parallel lines, SL and SL1, so an upside breakout from this pattern could suggest an important increase in the short term. USD/JPY is traded around 107.21 high, a valid breakout above this level could send the price towards the upper median line (uml) of the minor orange ascending pitchfork.

- USD/JPY Trading Tips

If the USD/JPY breakout above the SL1 and above the median line (ml) will be validated, the pair could approach and reach the upper median line (uml) of the minor ascending pitchfork and the 108.00 psychological level.

Personally, I would like to see a consolidation, sideways movement, right above the broken lines (SL, ml) before the price will continue its bullish momentum. I believe that only a valid breakdown below the 106.57 static support will invalidate a further increase and will suggest selling again.