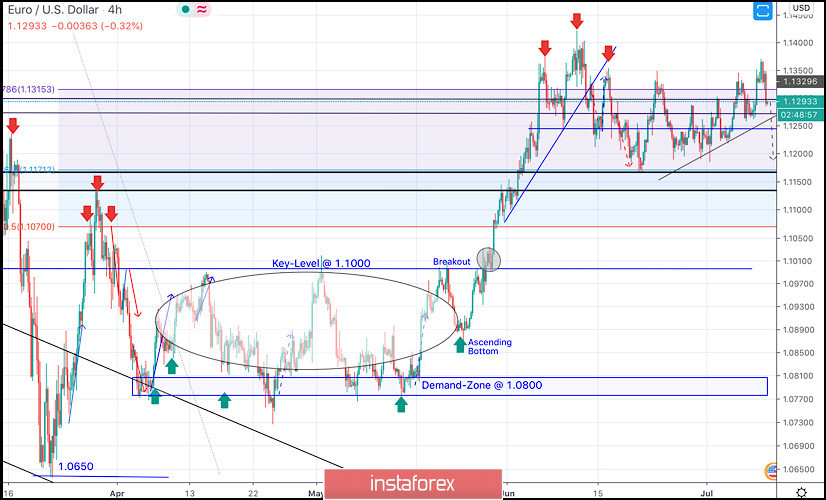

On March 20, the EURUSD pair has expressed remarkable bullish recovery around the newly-established bottom around 1.0650.

Shortly after, a sideway consolidation range was established in the price range extending between 1.0770 - 1.1000.

On May 14, evident signs of Bullish rejection as well as a recent ascending bottom have been manifested around the price zone of (1.0815 - 1.0775), which enhances the bullish side of the market in the short-term.

Bullish breakout above 1.1000 has enhanced further bullish advancement towards 1.1175 (61.8% Fibonacci Level) then 1.1315 (78.6% Fibonacci Level) where bearish rejection was anticipated.

Although the EUR/USD pair has temporarily expressed a bullish breakout above 1.1315 (78.6% Fibonacci Level), bearish rejection was being demonstrated in the period between June 10th- June 12th.

This suggested a probable bearish reversal around the Recent Price Zone of (1.1270-1.1315) to be watched by Intraday traders.

Despite the recent temporary bullish spike above 1.1350, Bearish persistence below 1.1250-1.1240 (Head & Shoulders Pattern neckline) is needed to confirm the pattern & to enhance further bearish decline towards 1.1150.

On the other hand, another bearish breakdown below the depicted keyzone around 1.1150 is mandatory to ensure further bearish decline towards 1.1070 and 1.0990 if enough bearish pressure is maintained.

Trade recommendations :

The recent bullish movement towards the price zone around 1.1300-1.1330 (recently-established supply zone) should be followed by Intraday Traders as a valid SELL Signal.T/P levels to be located around 1.1175 then 1.1100 while S/L to be placed above 1.1375.