Gold is trading lower at $1,953 level after the failure to reach the $1,981.35 all-time high. The price is trading in the red in the short term as the USD tries to recover versus its rivals. As you already know from my analysis, the yellow metal is bullish. So, a minor drop or correction could give us a great chance to go long again.

The COVID-19 crisis is far from being resolved, the global risk is high, a second wave could seriously hit the global economy, so the gold price could resume its uptrend anytime. Technically, a minor decrease could be natural as some of the buyers want to close their long positions.

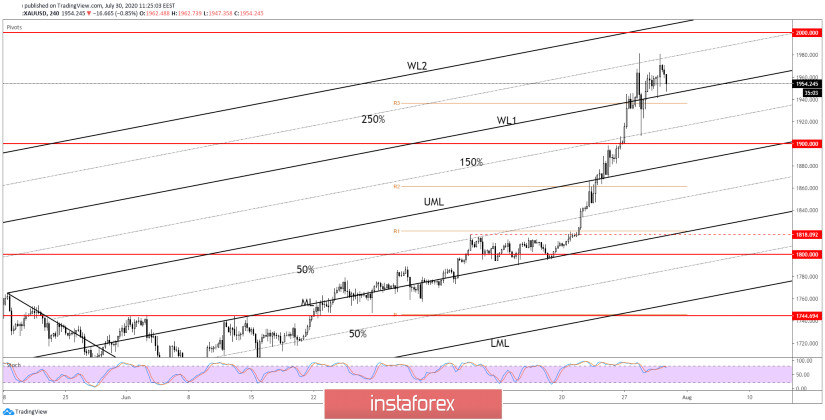

Gold is trading in the red again after another false breakout above the 250% Fibonacci line of the former ascending pitchfork. In yesterday's article, I've sustained that the price could try again to reach the $1,981 historical high, and that the 250% Fibonacci line remains an important target, dynamic resistance.

The price is about to reach the first warning line (WL1), dynamic support, most likely it will drop further if it closes and stabilizes below this obstacle. The 150% Fibonacci line is the next downside target. Gold could move sideways in the short term, could develop a continuation pattern.

- XAUUSD Trading Conclusion

Buy another higher high, a jump, and close above the $1,981 peak high, or another false breakdown below the warning line (WL1). The $2,000 psychological level and the second warning line (WL2) could be used as targets.

Sell a valid breakdown (close and retest) below the warning line (WL1), the near-term target is set at the 150% line, or lower at the $1,900 level.