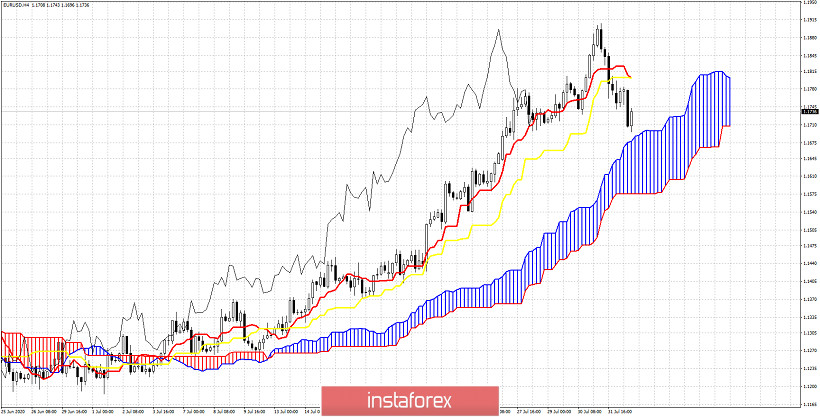

EURUSD as expected by our previous analysis has pulled back towards 1.17. Price has broken through the short-term support indicators and has almost reached the Ichimoku cloud and our first target for a pull back at 1.17.

Price remains in a bullish trend as we are still above the Kumo. Price is however below both the tenkan-sen (red line indicator) and the kijun-sen (yellow line indicator). Both indicators are now at 1.18 which is the most important short-term resistance level. In order for the bullish trend to continue towards 1.21 we need to recapture 1.18 and stay above it. In case bulls are unable to recapture 1.18 we could see a move inside the Kumo area towards the lower cloud boundary at 1.16. Bouncing off the cloud is a bullish sign. As we explained in our previous analysis, trend remains bullish and we expect a pull back as a buying opportunity. I do not expect to see a major top at current levels.