Prior +12.4%; revised to +12.3%

- Industrial production WDA -12.3% vs -11.6% y/y expected

- Prior -20.9%; revised to -20.4%

Similar to May, the rebound in euro area factory output was less-than-expected but still shows signs of improvement since bottoming out in April. That said, the recovery remains rather tepid with overall conditions still way off relative to that of a year ago.

Nonetheless, this pertains to Q2 data and it is pretty much a quarter that is written off at this point. The data over the next few months will offer a better indication of the recovery process and how sustainable that will be towards the end of the year.

As I discussed in the previous review, the EUR managed to complete the downside ABC correction and rejected pf support at 1,1720.

The level at 1,1720 and 1,1700 seems like solid support for the price today and there is potential for the upside rotation towards the 1,1900

Further Development

Analyzing the current trading chart, I found that the sellers got exhausted today and the upside roattion would be in the play.

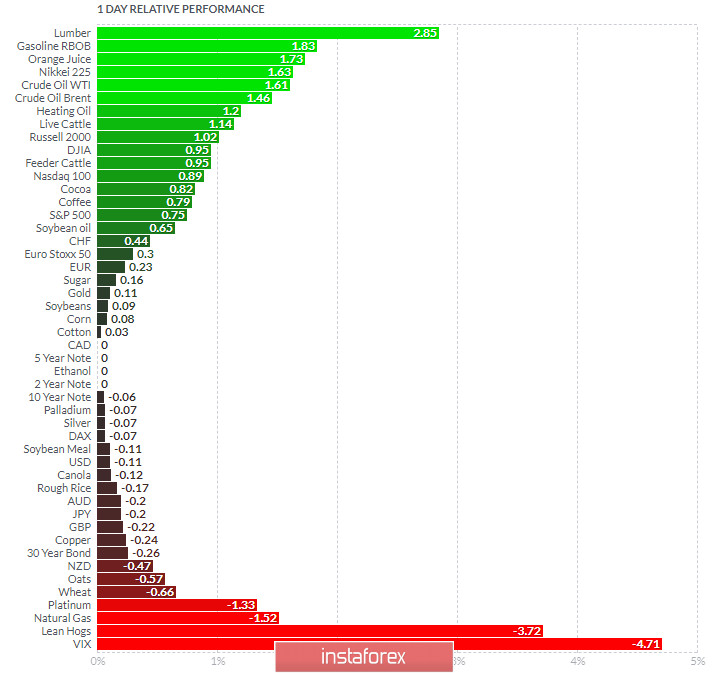

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Lumber and on the bottom Lean Hogs and VIX/

Key Levels:

Support: 1,1720

Resistance levels: 1,1810 and 1,1900