GBP/USD is bullish and is expected to trade higher after the current consolidation phase. It is trading at 1.3164, right below 1.3170 static resistance, a breakout will attract more buyers.

Technically, GBP/USD is located within an upwards swing, the short-term sideways movement represents an accumulation before the pair resumes the uptrend. The greenback has resumed its downside movement versus its rivals.as USDX. A USDX's valid breakdown somewhere below the 92.53 level will open the door for more declines, this scenario will announce the USD's further depreciation.

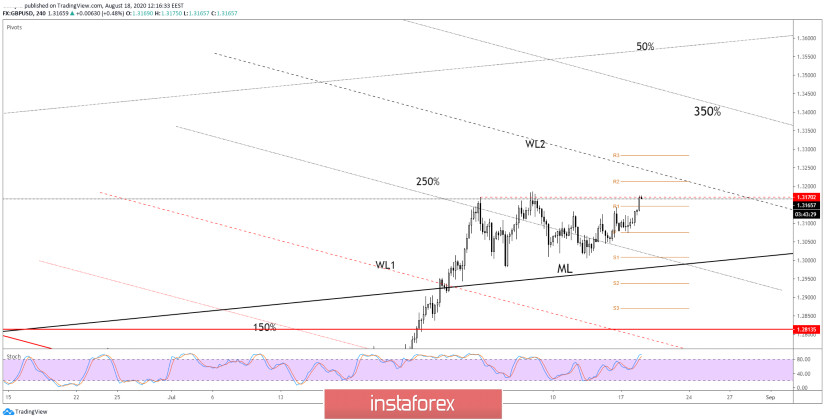

GBP/USD is pressuring the 1.3170 static resistance after the aggressive breakout through the R1 (1.3164) level. I've said in my previous analyses that, GBP/USD should climb towards fresh new highs if it stabilizes above the 250% Fibonacci line and after the failure to come back to retest the median line (ML) of the major ascending pitchfork.

- GBP/USD Trading Recommendations

Buy another higher high, jump, and close above the 1.3185 level. Technically, the second warning line (WL2) is seen as potential dynamic resistance, but I strongly believe that another higher high will send the rate higher towards the 350% Fibonacci line, near 1.3350 level. Still, the R3 (1.3283) level could be used as a near-term target.

A minor selling opportunity could appear only if GBP/USD makes a strong reversal pattern here around 1.3170 level, this scenario is less likely to happen.