European banks not likely to recover from the virus crisis before 2022

- The recovery of the Eurozone economy will be a vital factor in banks' solvency

He's not really touching on anything important in his lecture today, but the ECB in general doesn't have much to offer as they are in a wait-and-see mode currently. Policymakers are largely looking to assess the pace of the recovery and how sustainable it is before painting their next bias and strategising for next year.

As I discussed in the previous review, the Gold managed to break the inside day balance to the upside and is heading towards our first upward target at $2,025.

Further Development

Analyzing the current trading chart of Gold, I found that the buyers are in control second day after the breakout of inside day and that Gold may fully recover from the massive selling climax.

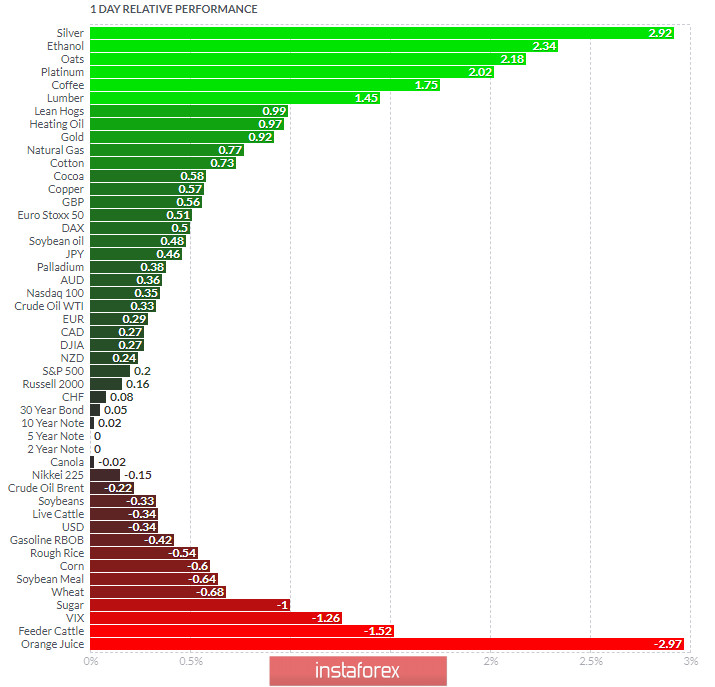

1-Day relative strength performance Finviz:

Based on the graph above I found that on the top of the list we got Silver and Ethanol today and on the bottom Orange Juice and Feeder Cattle.

Gold is in the positive territory, which is good indication that buyers are in control today.

Key Levels:

Resistance: $2,015 and $2,045