But just take note that with all things OPEC+ related, there's a likelihood it could be delayed for a few minutes or hours and what not. So, it will happen when it happens.

That said, the meeting today is likely just to reaffirm the bloc's commitment to production cuts and to assess the compliance over the past two months.

The July compliance is slated to be at around 95% to 97% - down from 107% in June - but it shouldn't be much of a problem all things considered, especially since oil prices are holding at more favorable levels (at least from the bloc's perception).

The Gold is in the downside correction in my opinion and it is near the middle Bollinger band.

The zone at $1,978-$1,966 seems like solid support pivot and you should watch carefully for the price action around it.

Further Development

Analyzing the current trading chart of Gold, I found that there is potential completion of the downside correction and continuation of the uptrend.

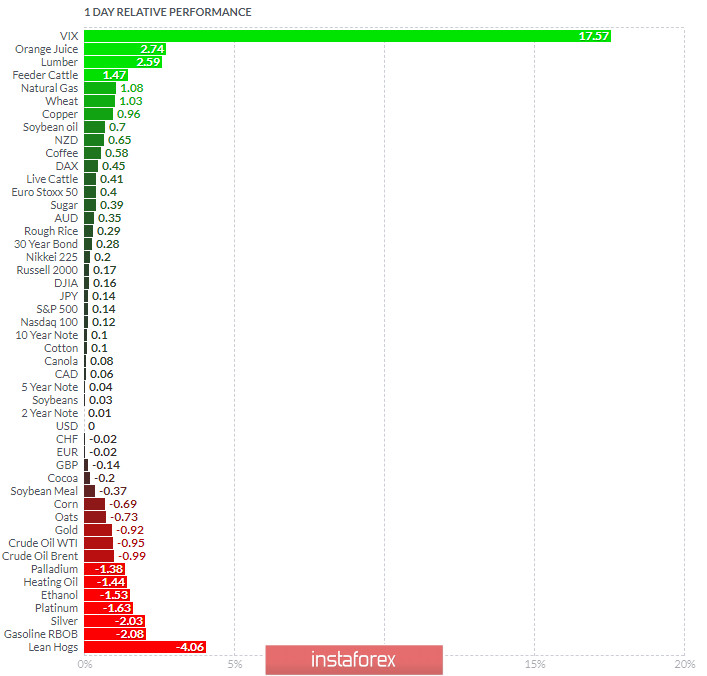

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got VIX and Orange Juice today and on the bottom Lean Hogs and Gasoline RBOB.

Gold is in the bottom of the list, which is sign that sellers are in control today.

Key Levels:

Key pivot support level is set: $1,978

Resistance level: $20,15