The major central banks, in consultation with the Fed, jointly decide to reduce further the frequency of 7-day operations

TThe frequency of 7-day dollar operations will be reduced from three times per week to once per week, while the 84-day operations will still continue to be offered weekly. The changes will kick into effect from 1 September.

The major central banks do reaffirm though that they stand ready to re-adjust the provision of dollar liquidity as they see fit based on market conditions.

Just be reminded that these swap lines have largely helped with calming the market down and alleviating funding stress and a liquidity crunch back in late March and early April.

But with market conditions a lot calmer at the moment, they are slowly being weaned off so just be mindful that the "insurance" in the market is slowly taken out.

That said, you can be rest assured that they will be quickly reinstated should we see a repeat of the March meltdown across multiple asset classes in the market.

The EUR/USD got the sell off yesterday towards the 1,1805 on the FOMC day but it is still in the upside trend.

Further Development

Analyzing the current trading chart of EUR/USD, I found that the sellers got exhausted today and the uspide roattion would be probably to correct strong downside movement from yesterday.

There is potential for re-test of the swing high at 1,1953.

Watch for buying opportunities...

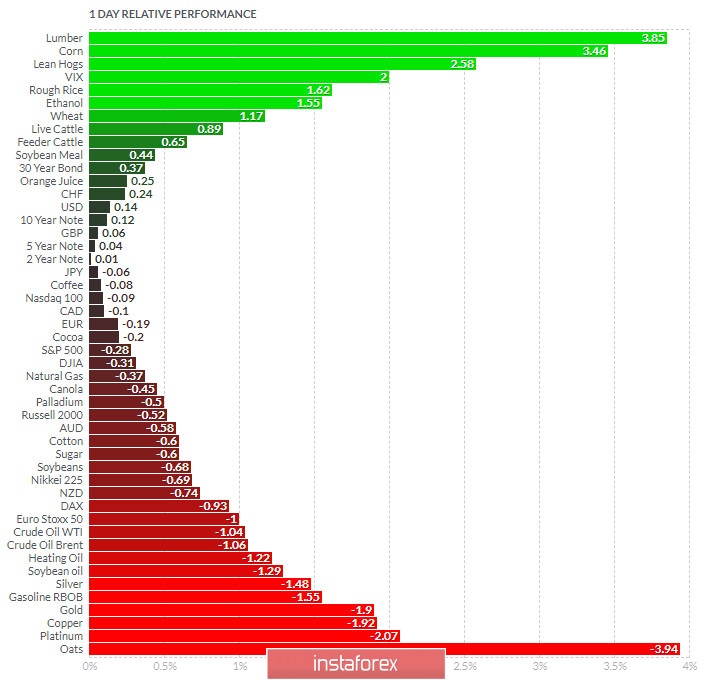

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Lumber and Corn today and on the bottom Oats and Platinum.

EUR is in the neutral zone, which confirms exhaustion.

Key Levels:

Resistance:1,1953

Support level: 1,1800