Comments by the Chinese commerce ministry

No specific mention on when that will be or how soon is 'soon'. But after the delay from last weekend and both sides happy enough to maintain the current facade, it doesn't look like there will be much pressure to engage with one another as soon as possible.

In any case, even if they do meet, it is unlikely to change the current narrative as both sides also have vested interests to keep the current act going.

The Gold got the sell off yesterday towards and it found support at the important pivot level at $1,927.

Further Development

Analyzing the current trading chart of Gold, I found that the sellers got exhausted today and the uspide roattion would be probably to correct strong downside movement from yesterday.

There is potential for re-test of the swing high at $1,955 and $1,974

Watch for buying opportunities on the dips.

Additionally, there is the bull divergence on the Stochastic oscillator, which is another sign that sellers became exhausted.

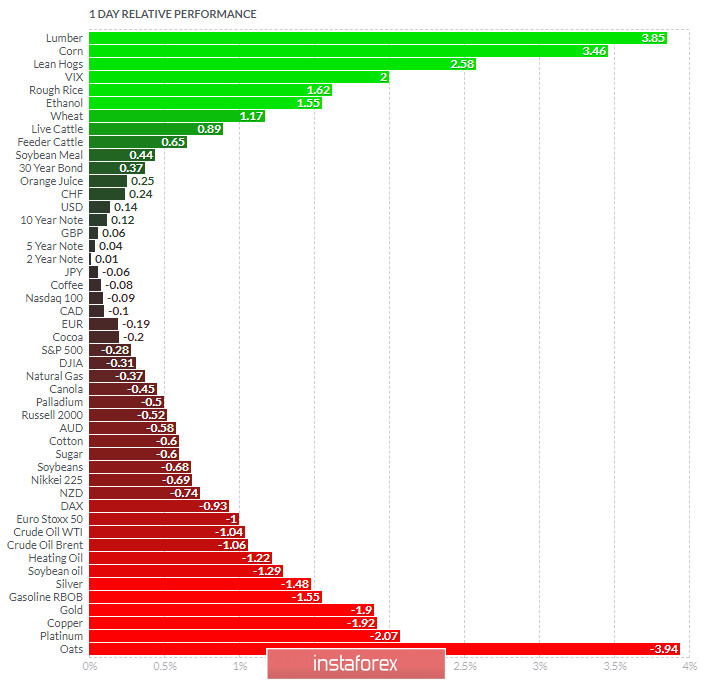

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Lumber and Corn today and on the bottom Oats and Platinum.

Gold in the bottom of the list but with the momentum decreasing.

Key Levels:

Resistance: $1,955 and $1,974

Support level: $1,920