Markit/CIPS - August 21 2020

Prior 54.7

- Manufacturing PMI 51.7 vs 52.9 expected

- Prior 51.8

- Composite PMI 51.6 vs 54.9 expected

- Prior 54.9

The earlier release from Germany and France pointed to a slow down in the PMI data and the European data is below expectations across the board. EURUSD down a few ticks towards session lows. This does not bode well for Friday in terms of risk, UK PMI's to come in 30 minutes.

This is a pivotal point for the eruozone and the slowing recovery picture will be eyed carefully by the ECB.

As I discussed in the previous review, the Gold is testing the lower part of the trading range at the price of $1,925, which is potential for the upside rotation.

The level at $1,925 seems like solid support for the price today and there is potential for the upside rotation towards the Middle Bollinger band at $1,945

Further Development

Analyzing the current trading chart of Gold, I found that the bottom of the trading range is serving like support and that is very risky for selling at this stage.

Watch for buying opportunities with the target at $1,954

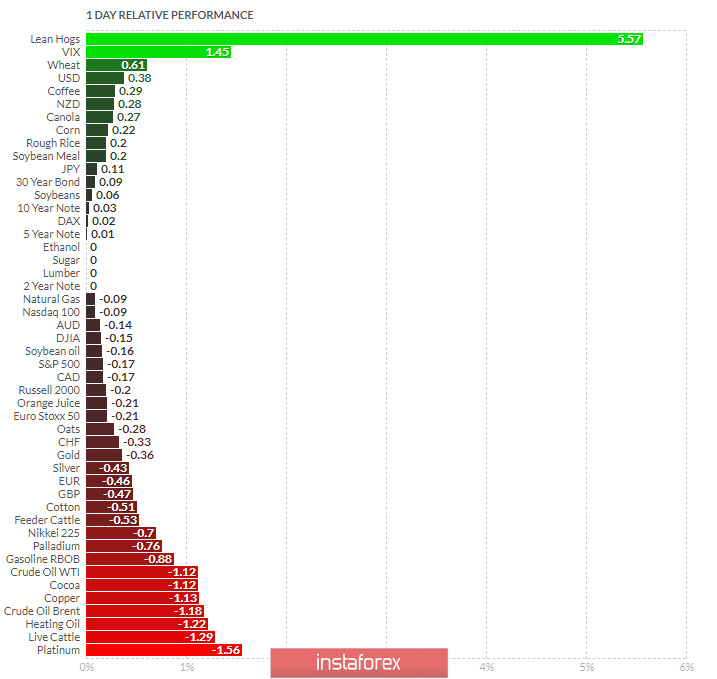

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Lean Hogs and VIX today and on the bottom Platinum and Live Cattle

Gold is on the bottom of tthe lust but with the test of the lower part of the trading range

Key Lvels:

Resistance: $1,954

Support level: $1925