The initial growth fueled by anticipation of tax reform program and production stimulation seems to be fading, as manufacturing activity in the US is lagging. PMI indexes are currently at a record 8-month low, along with the decline of regional indices. Orders for durable goods went down by 1.1% in May, which is linked to the previous month's slump. This is the second consecutive time the figure went down, and reduction rates total at around a maximum of six months.

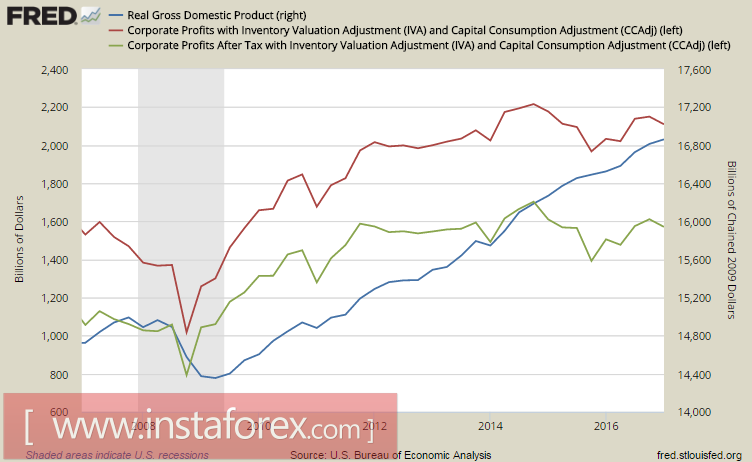

As illustrated in the graph below, the depreciation of durable goods has a second aspect as well. The corporate earnings after the 2008 financial crisis can be seen, indicating that until 2012, the profits hike at the same pace as the economy. However, revenue growth displayed a significant slowdown, which is particularly shown on acquired profits after taxation.

Currently, corporate profits in absolute terms are the same as 5 years ago. The economic growth was mainly bolstered by a rebound in consumer demand, which resulted in the development of the labor market and disposable income hence, a hike in consumer spending.

Despite this, recent trends are quite disappointing. First, the volume of retail sales last month were in a two-year low, just like consumer inflation. There are signs of decline in the demand for durable goods signaling a decrease in consumer activity. Moreover, the improvement of the labor market primarily lies on the boundaries of minimal unemployment.

The present state of corporate incomes is deemed a crucial factor in evaluating the prospects of the US economy. Recently, Agency Factset has released a review of the stock market and notes a few patterns. For instance, while the S&P 500 index are headed for highs, many of the firms included in the index disclosed a decrease in the second quarter, relative to March 31, 2017, which is a decline in corporate revenues in Q1. Coupled with a weakened consumer demand, this pattern will lead to a lower tax collection, which will result to conflicts in terms of budget filing.

These outcomes are considered as unsatisfactory especially because it also affected the greenback negatively. Reasons for the currency's growth are becoming less. The international Monetary Fund also began to lower their outlook for the US economy, as any signs of Trump's program such as infrastructure spending and tax reforms remain unclear. It now expects a 1.7% growth rate in 5 years, compared to its April projections of 2.5% annual growth.

In addition, the present situation in the US posts a sharp contrast with the forecasts of the Fed and CBO, which are considered as excessively optimistic. The weak economic state has lured away investors, especially since improvements are starting to show in the euro area. Most of them dismissed Yellen's statements that the US is more stable now than before the 2008 crisis. Instead, most of them are anticipating another recession, and are preparing for a worst-case scenario.

There are chances the situation might change on Friday, when data on personal expenses and income in April is reported. However, it is also possible the results will develop to be worse than what the market expects.

The dollar finds itself in the midst of a pressure, and barely has a reason to continue growth.