Lawmakers continue to talk up the economic recovery but for Germany, it is also important to watch their views in case it also alludes to potential fiscal developments going into next year i.e. the 'debt brake' issue.

A potential market concern is that the economy may be moving in the right direction, so lawmakers choose not to suspend the 'debt brake', but that in itself may hinder the path towards a quicker and more sustained recovery down the road.

As I discussed in the previous review, the is still trading inside of the overall trading range between the price of $1,923 (support) and resistance at $1,955.

Further Development

Analyzing the current trading chart of the Gold, I found that the sellers got ehausted at the the main pivot support at $1,923 and that buyers showed up.

I would watch for potential buying opportunities with the potential for testing of $1,937 and $1,955.

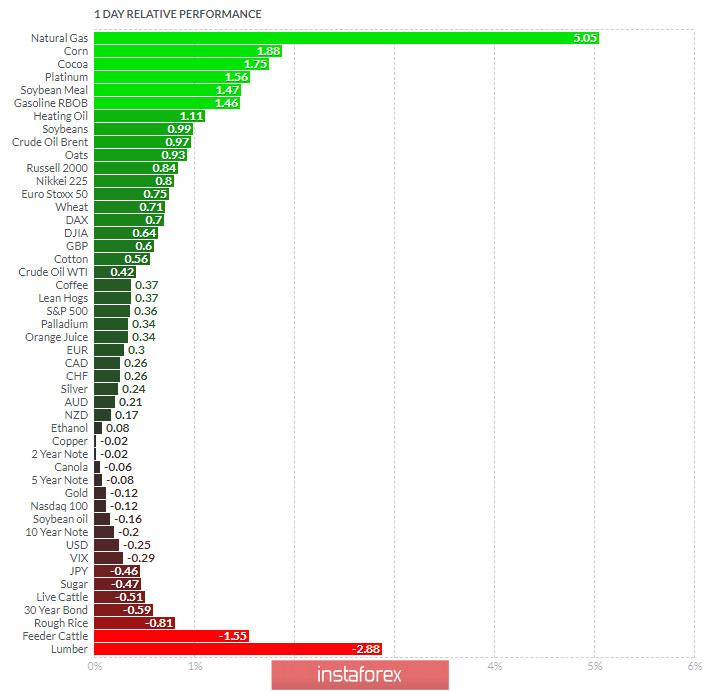

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Natural gas and COrn today and on the bottom Lumber and Feeder Cattle.

Gold is slightly negative with no evidence of any directional move.

Key Levels:

Resistance: $1,937