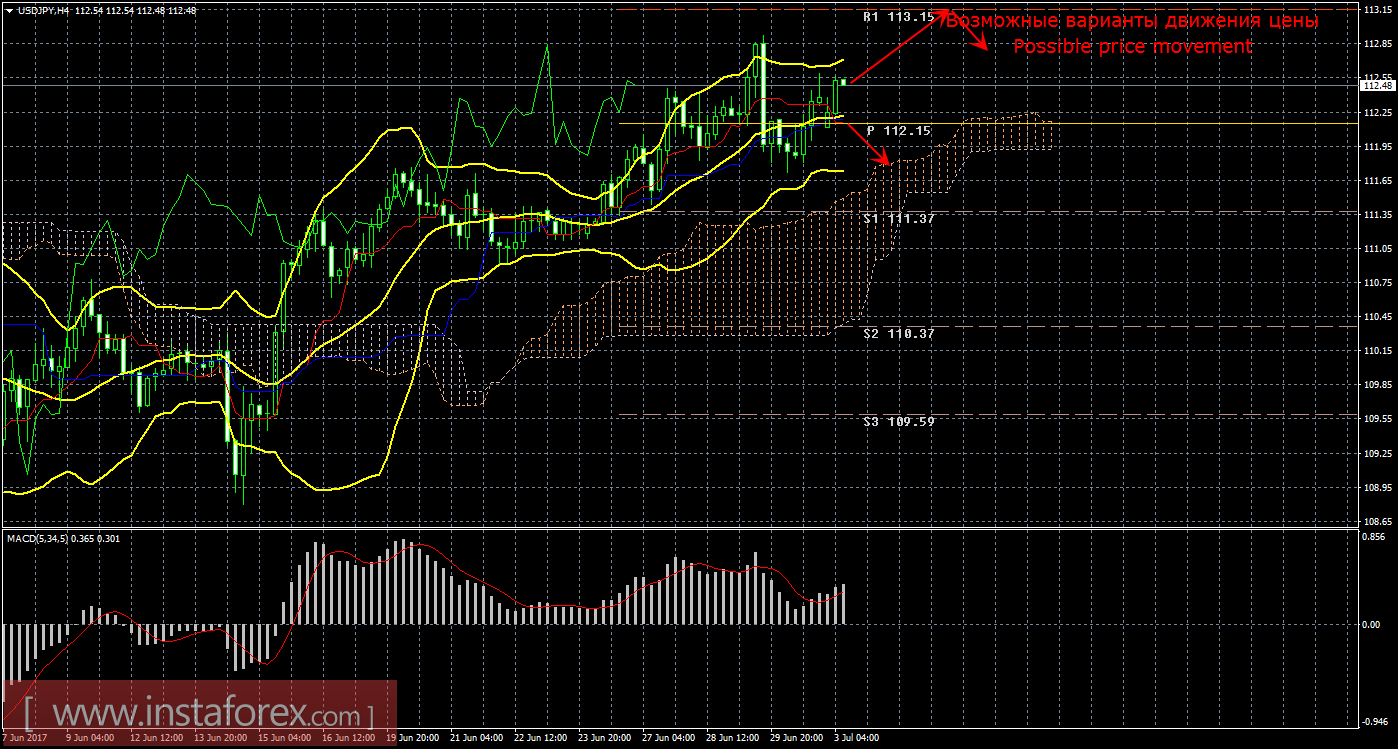

4-hour timeframe

The amplitude of the previous day (high-low): 87 points.

The distance of the past day: 270 points.

THE BIG PICTURE:

If the price falls below this line, the current "golden cross" will become weak again.

Trading recommendations:

The Japanese yen in the Foreign exchange market is recommended to consider buying the pair with the first target at 113.15 level followed by 113.93 as the second target.

Aside from the technical aspect, traders should also consider the fundamental data and their scheduled releases.

When there is a possibility to open deals in advance, switch to the smaller timeframe (M15-M30) and monitor the reversal of the trend indicators (e.g. Heiken Ashi) considering the price level and the possibility for a pullback.

Explanation of the picture:

Ichimoku:

Tenkan-sen - red line.

Kijun-sen - blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple stipple line.

Chinkou Span - green line.

Bollinger Bands indicator:

3 yellow lines.

MACD indicator:

The red line and the histogram with the white bars in the indicators window.