Following the rise of the European currency last week, which took place against the backdrop of comments from European Central Bank President Mario Draghi, at the start of this week there is a downward correction phase that will last for a short time if the bulls stay above important support levels.

Today, the volatility of markets in the second half of the day will be very low due to the celebration of the US Independence Day, which can lead to an increase in new long positions in the European currency.

Let me remind you that last week Mario Draghi's statements were seen as a signal to a tightening of the monetary policy, which led to a sharp demand for the European currency. Also, the yield on the government bonds of eurozone countries jumped.

Yesterday's data on the US economy led to a small wave of growth in the US dollar.

According to the report of the Commerce Department, construction costs in the US in May of this year remained unchanged, indicating the excellent condition of the real estate market. Total construction costs in May were unchanged compared with April, at the level of 1,230 trillion dollars. Economists had expected spending to increase by 0.3% in May.

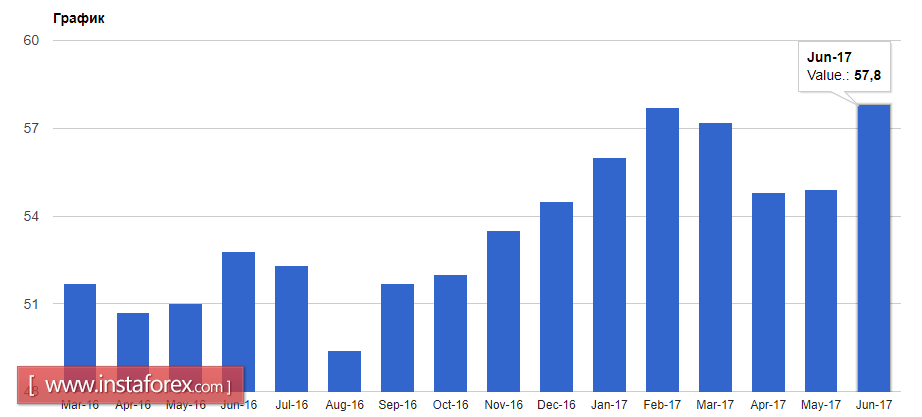

Manufacturing activity in the US in June increased, providing support for the US dollar in the afternoon, which indicates a sustained positive momentum in the manufacturing sector.

According to the Institute of Supply Management, the Purchasing Managers' Index for the US manufacturing sector rose to a level of 57.8 points in June from 54.9 points in May. Economists had expected that in June the index would be at 55.5 points.

Despite the downward correction in the EURUSD pair, the upward potential for the euro and the bullish trend will continue this week. If the buyers of the euro will be able to return to the intermediate trend line in the near future, located in the resistance level of 1.1380, then we can expect the formation of a larger bullish momentum. The only problem now is a lack of major players due to a holiday in the US. The main task for the next few days for euro bulls will be a breach above 1.1410, which will update the weekly highs as early in the second half of this week.

If the sellers of risky assets make a break below the support level of 1.1330, then the pressure on the euro could rise sharply, leading to an important support level of 1.1250 and will indicate a change in the short-term upward trend for the euro that was formed last week.