Versatile fundamental statistics from the euro area today has led to a small sale of the euro against the US dollar.

The data, which was released in the morning, showed that the German Services PMI (Purchasing Managers Index) for June increased beyond the preliminary estimate.

According to the IHS Markit report, the German Final Services PMI index grew to 54.0 points against the expected 53.7 points. Meanwhile, the German Composite PMI was at 56.4 points and has been adjusted in respect to the preliminary estimate of 56.1 points. IHS Markit expects that this year, Germany's GDP growth will be 2%.

Bad data on the euro area led to the sale of euro. Despite this, the projection for the eurozone's economic recovery is for it to accelerate in the second quarter of the year.

The IHS Markit report also added that the final composite PMI for the eurozone dropped to 56.3 points for the month of June from 56.8 points in May. Taking into account the preliminary data where the index was expected to decline to 55.7 points, it can be said that there is a slight slowdown in growth because of a time factor.

On the other hand, retail sales in the euro area rose. According to Eurostat. Retail sales in May grew by 0.4% from April's data, significantly exceeding the forecasts of economists. The data may lead to a more stable economic growth rate for the second quarter. Inflation will also be positively affected as expected by the European Central Bank recently.

As for the technical picture of the EURUSD pairing, sellers are trying to reach for a consolidation below 1.1340 which can lead to a new round of selling for the European currencies. However, the pressure on the euro is most likely to remain on the Fed's protocol meeting later today.

It is expected that a more detailed study will make it clear when the committee will start reducing their asset portfolio. Currently, experts anticipate the reduction on September of this year.

Meanwhile, the British pound ignored the date for the services sector.

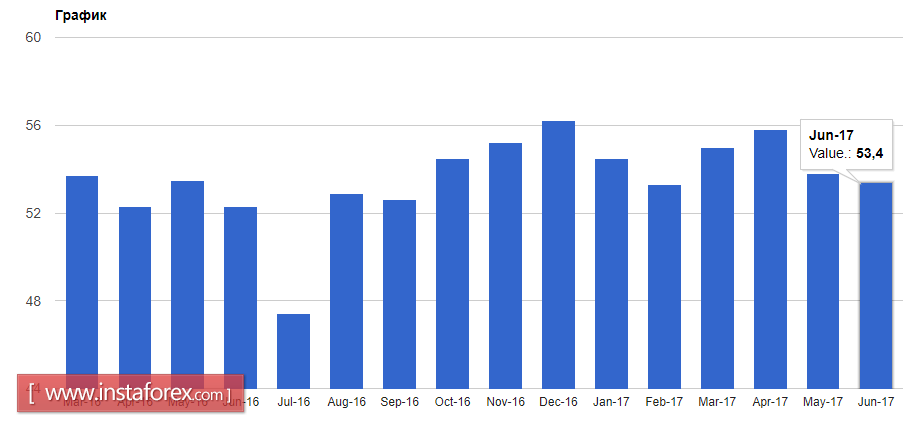

According to the IHS Markit report, the PMI for the UK service sector fell to 53.4 points in June from 53.8 points in May. Despite a slight decline, the service sector remains a major factor for the UK's economic growth. The service sector results could also be a wake-up call for the Bank of England who is currently focused on tightening monetary policies. Economists expected the index to be at 54.5 points.