Prior +9.2%

Slight delay in the release by the source. Broad money expands further in July amid the continued liquidity injections by the ECB. Loans to households kept steady at +3.0% y/y and so did loans to non-financial corporations at around +7.0% y/y.

As I discussed in the previous review, the Gold managed to reject of thje important pivot support at the price or $1,912 and test the resistance at $1,957.

Further Development

Analyzing the current trading chart of Gold, tI found that the Gold is now on critical pivot resistance at $1,857.

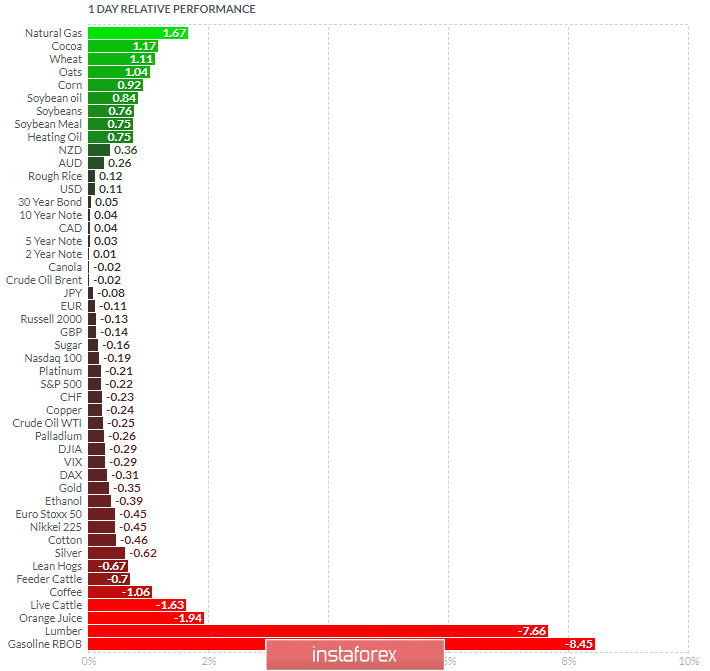

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Natural gas and Cocoa today and on the bottom Gasolive RBOB and Lumber

Gold is neutral, which is confirming indecision.

Key Levels:

Resistance: $1,957

Support levels: $1,912