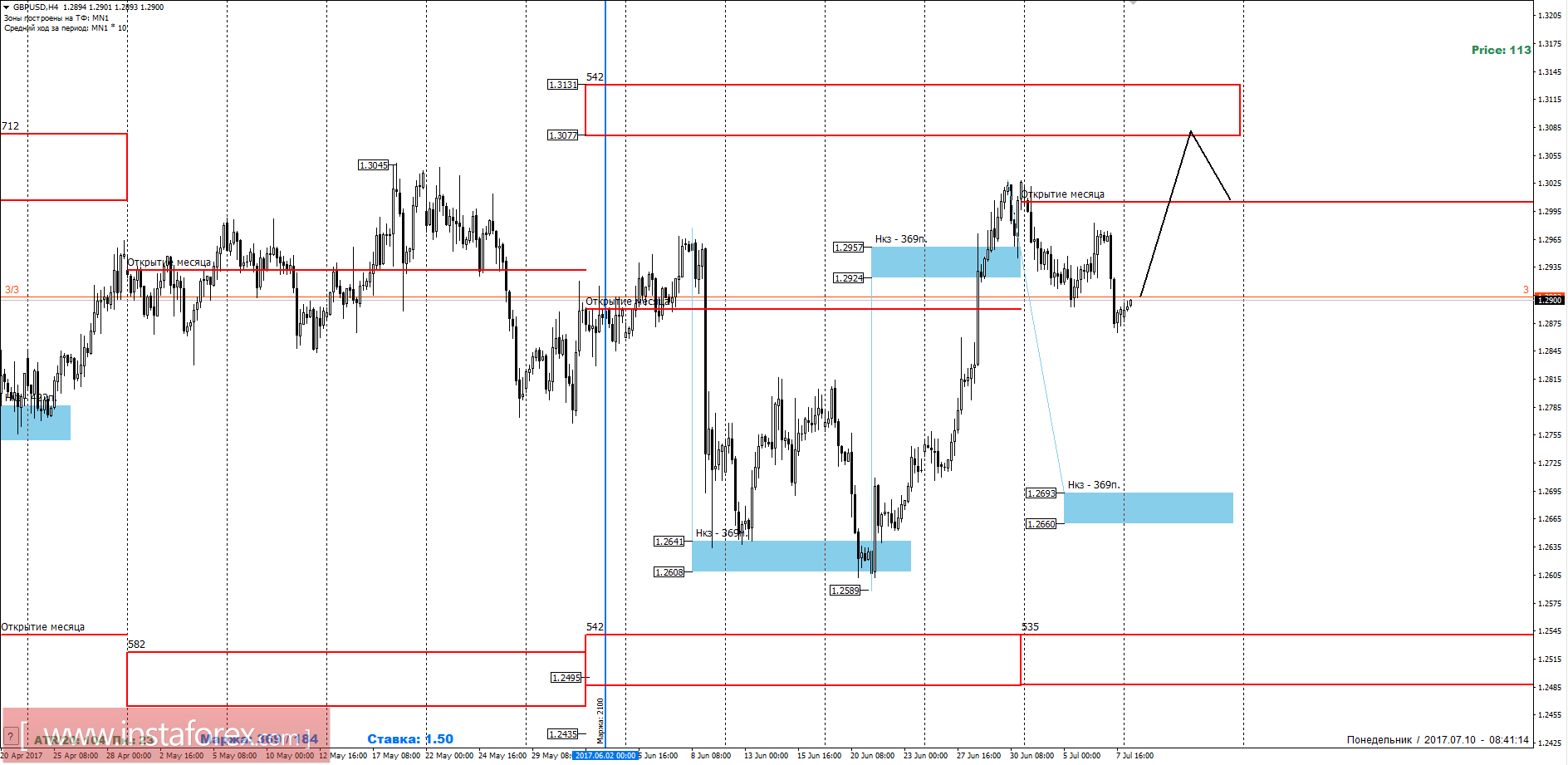

The third month continues to form a long-term accumulation zone. The pair is trading in the range between the levels of 1.3045 and 1.2589. Monthly control zones are located near these marks which makes them more meaningful.

Medium-term plan.

Last week, there was a corrective movement towards the last increase. The continued downward movement will allow the pair to return to the range of a long-term flat. In order for the bullish momentum to continue, it will be necessary to fix the price above the last week's opening point. This will allow players to talk about interest in strengthening the pound. It is important to note that a strong resistance will be made by NKZ for the month of June at 1.3131-1.3077. Testing this zone will increase the likelihood of a large offer, which compel players to close most of their buys when it reaches that range

To form an alternative downward pattern, you need to fix the price below the last week's low. This will open the way for the fall to the week-long short-term at 1.2693-1.2660.

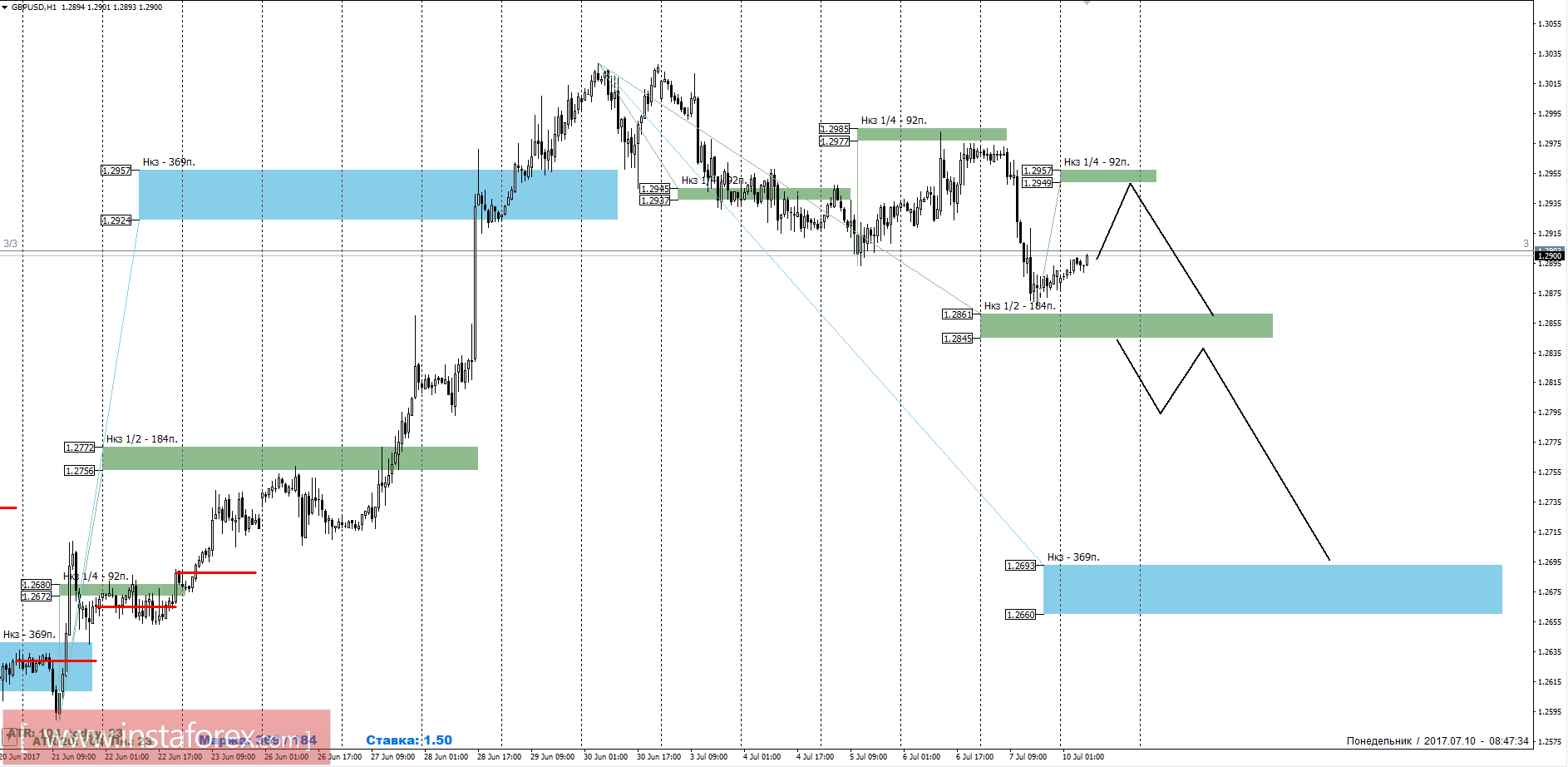

Intraday plan.

Last week, the pair did not reach the main support in the form of 1.2861-1.2845. While the instrument is trading above this zone, growth remains the priority. And the first goal is to test of the June maximum. The closest resistance can be considered to be at 1.2957-1.2994. While the pair is trading below this zone, the probability of the 1.2861 test remains high. In order for the formation of a top-ranking reversal pattern to take place, one of the American sessions will need to be closed below the level of 1.2845. This will make it possible to look for sales for the weekly short-term call at 1.2693-1.2660.

Day - day control zone. The band formed by important data from the futures market, which changes several times a year.

Week - week control zone. The band formed by important marks of the futures market, which changes several times a year.

Month - monthly inspection zone. The zone, which is a reflection of the average volatility over the past year.