Latest data released by Eurostat - 28 August 2020

- Prior 82.3

- Industrial confidence -12.7 vs -13.0 expected

- Prior -16.2

- Services confidence -17.2 vs -23.0 expected

- Prior -26.1

There are continued improvements to overall economic sentiment within the euro area this month and that reflects the ongoing optimism surrounding the recovery for the time being.

With fears of a second virus wave brewing, it remains to be seen if the optimism can be justified as we look towards the latter stages of the year.

Gold is still trading inside of the trading range and there is potential for the breakout of rejection.

Further Development

Analyzing the current trading chart fo Gold, I found that the Gold is still in the trading range between the price of $1,975 (resistance) and $1,912 (support)

To confirm further upside I would like to see breakout of $1,975, which would lead the Gold for test of $2,000

The rejection of the important pivot at $1,975 can lead the Gold lower towards the $1,912

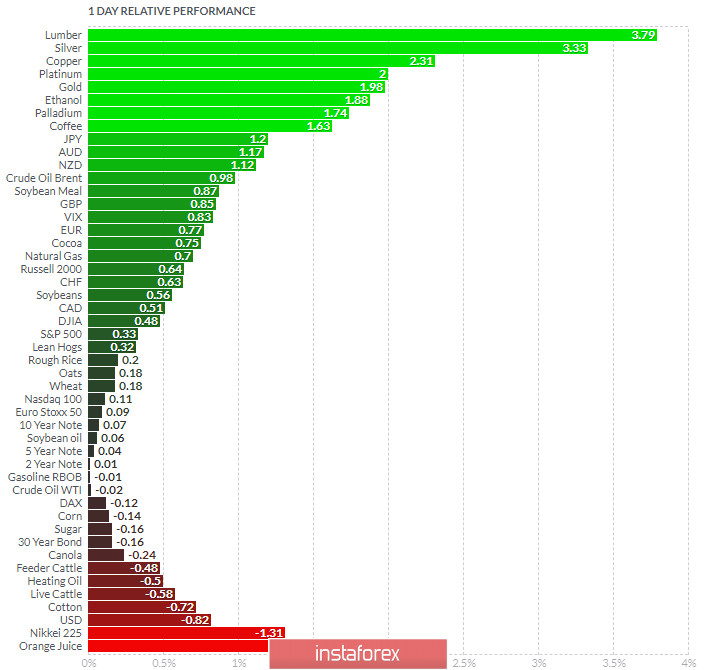

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Lumber and SIlver today and on the bottom Orange Juice and Nikkei 225.

Gold is in green today but in the overbought condiiton...

Key Lvels:

Resistance: $1,975

Support levels: $1,91