Friday's US employment data exceeded all expectations, increasing the likelihood of the US Federal Reserve raising rates until the end of this year.

Published at the end of last week, employment data in the non-agricultural sector of the US was significantly higher than all forecasts including Bloomberg's consensus forecast which assumed a range of new jobs from 140,000 to 200,000. According to the figures released, new jobs increased by 222,000 against the expected growth of 170,000. The number broke out of the range itself which occurred for the first time in recent months. It is important to note that the May values were raised when the data was revised to 152,000 from 138,000. On the wave of this positive outcome, several unemployment rates rose to 4.4% but this change is insignificant and has no decisive influence.

Against the background of Friday's good data, the dollar grew locally but fell again. This behavior of the market can be explained by the expectations that the world's largest securities - the European Central Bank , the Bank of England, as well as the Canadian regulator who joins them - will begin to change their attitude towards the course of their monetary policies. This is a fundamental factor that restrains the growth of the dollar against the euro, sterling, and the Canadian currency. As for other major currencies, they also follow the general pattern of market views and are supported by the prospect of initiating interest rates hikes in Australia and New Zealand. The only one who gets out of this chorus in the Central Bank of Japan whose leader previously confirmed the continuation of the current economic policy that's stimulating the economy.

That's why we are seeking a weak dollar. The weakness is in the Central Banks mentioned above which will likely withdraw the stimulation of their respective economies. This week, the Bank of Canada is already planning to raise interest rates from 0.50% to 0.75% supporting the "Canadian" despite the drop in oil prices.

However, in the wake of these era-making changes, the currencies of the developing countries will remain as the underdogs, including the Russian currency which is currently experiencing a double blow from the drop in oil prices and the decline of foreign interest in OFZs in terms of carry trades in government bonds.

Forecast of the day:

The EURUSD pair consolidates at maximum values which has been reached previously. The pair is supported by the expectations of a change in the ECB rates towards a normalization of the monetary policy. On this wave, the pair could grow to 1.1460 if the breakout is at 1.1425. However, it is also possible for the pair to fall down to 1.1420 when overcoming the level of 1.1390. In general and in watching the behavior of the pair, it can be said that a certain equilibrium has been established. This will be only overcome after the release of data on consumer inflation in the United States which will be released by the end of this week. Low figures in the indicator will lead to further price growth while the reverse picture will cause further correction.

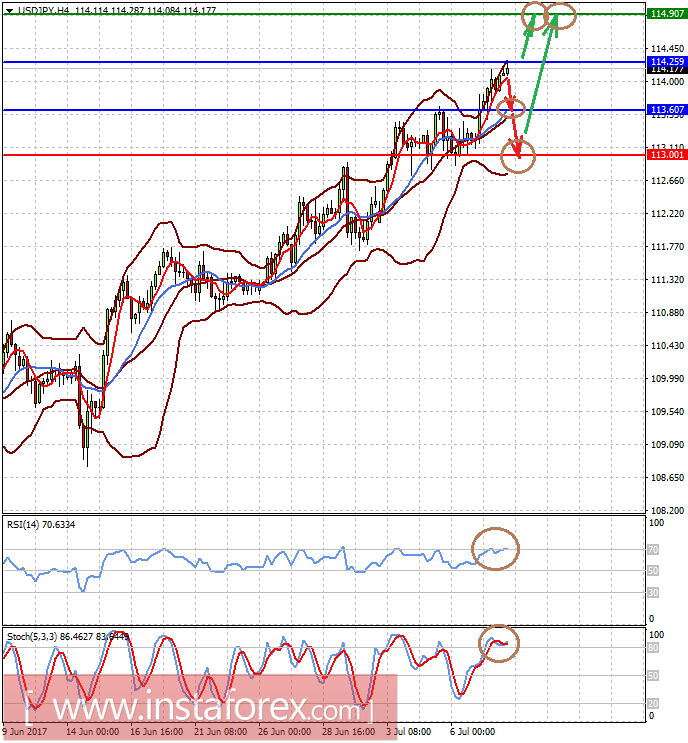

The USDJPY pair is likely to adjust down to 113.60 or even lower to 113.00 on the wave of local overbought. However, this decline appears to be for the short-term as the discrepancy on the rates of monetary policy of the Fed and the Central Bank of Japan is still present. Against this background, the pair can resume growth to the range of 114.90-115.00.