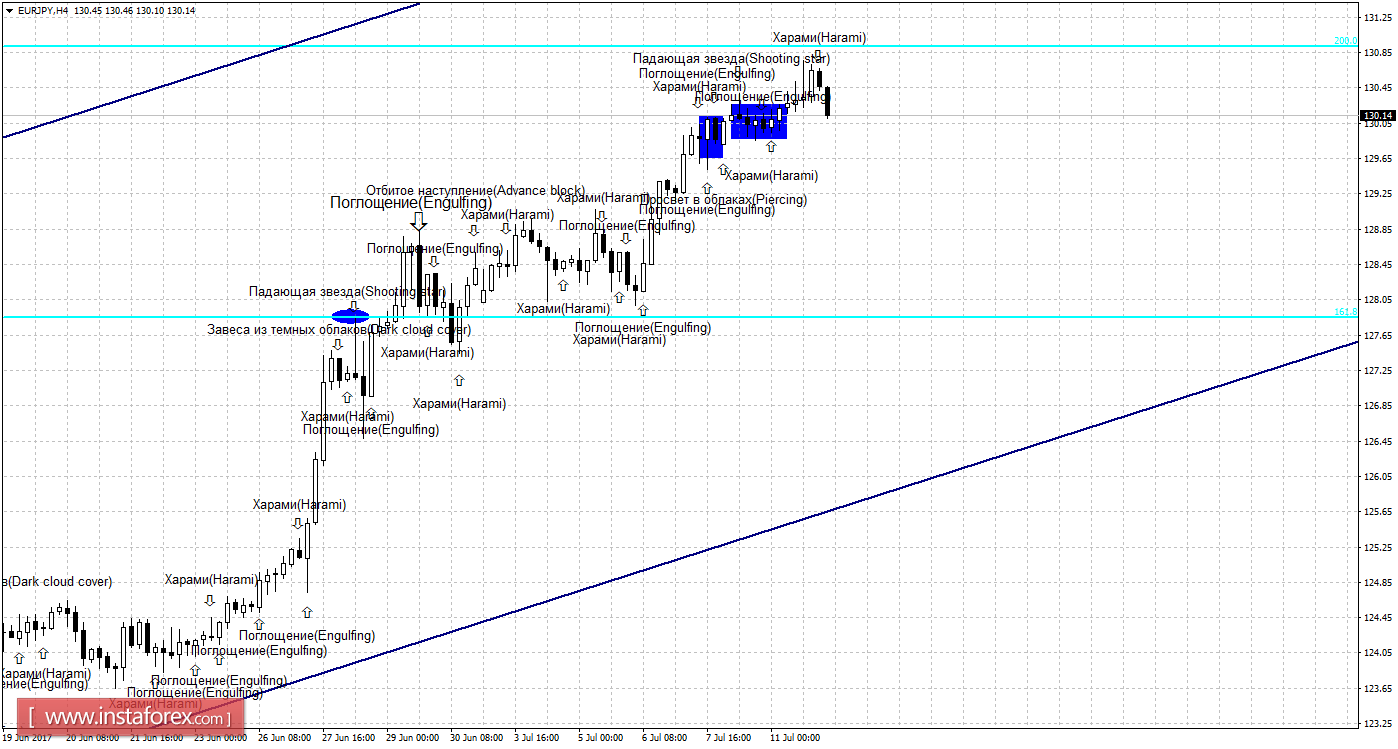

4h

The formation of the bull pattern on July 12 would allow traders to anticipate a trend beneficial for the European currency. The growth will continue through the direction of the correction level of 200.0% - 130.91. Such formation will be recognized as a trend based on the direction of the equidistant channel. Setting the rate above the Fibo level of 200.0% will increase chances of consistent growth towards the next correction level of 261.8% - 135.91.

The Fibonacci grid is established on the upper limits of March 13, 2017 and April 17, 2017.

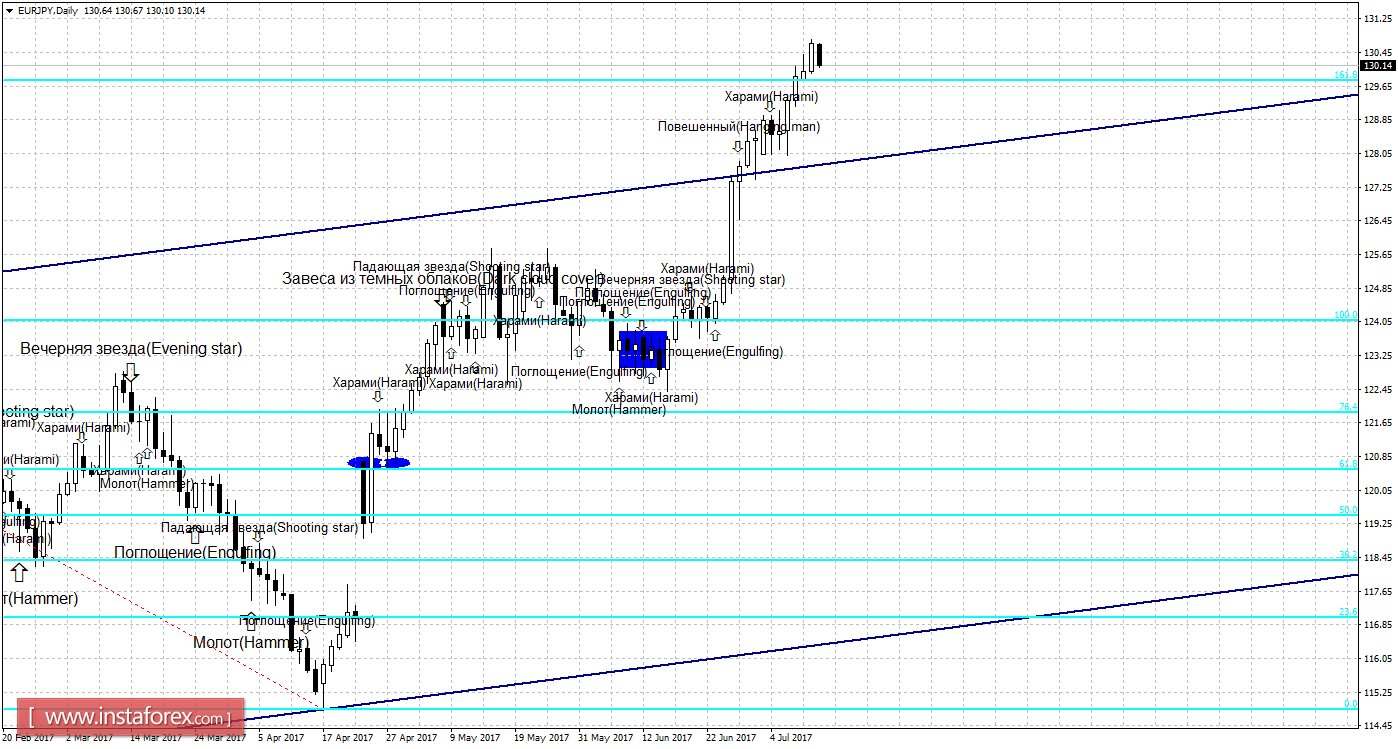

Daily

In the 24-hour chart, the prices were fixed above the correction level of 161.8% - 129.78, which eventually allows to resume the growth towards the next Fibo level of 200.0% - 133.33.

The Fibonacci grid is placed on the extremes from December 15, 2016 and April 17, 2017.

Specification:

Weak candle formations will be marked by plain text with a smaller size of the arrows.

Strong candle formations will be marked by bold text with a larger size of arrows.