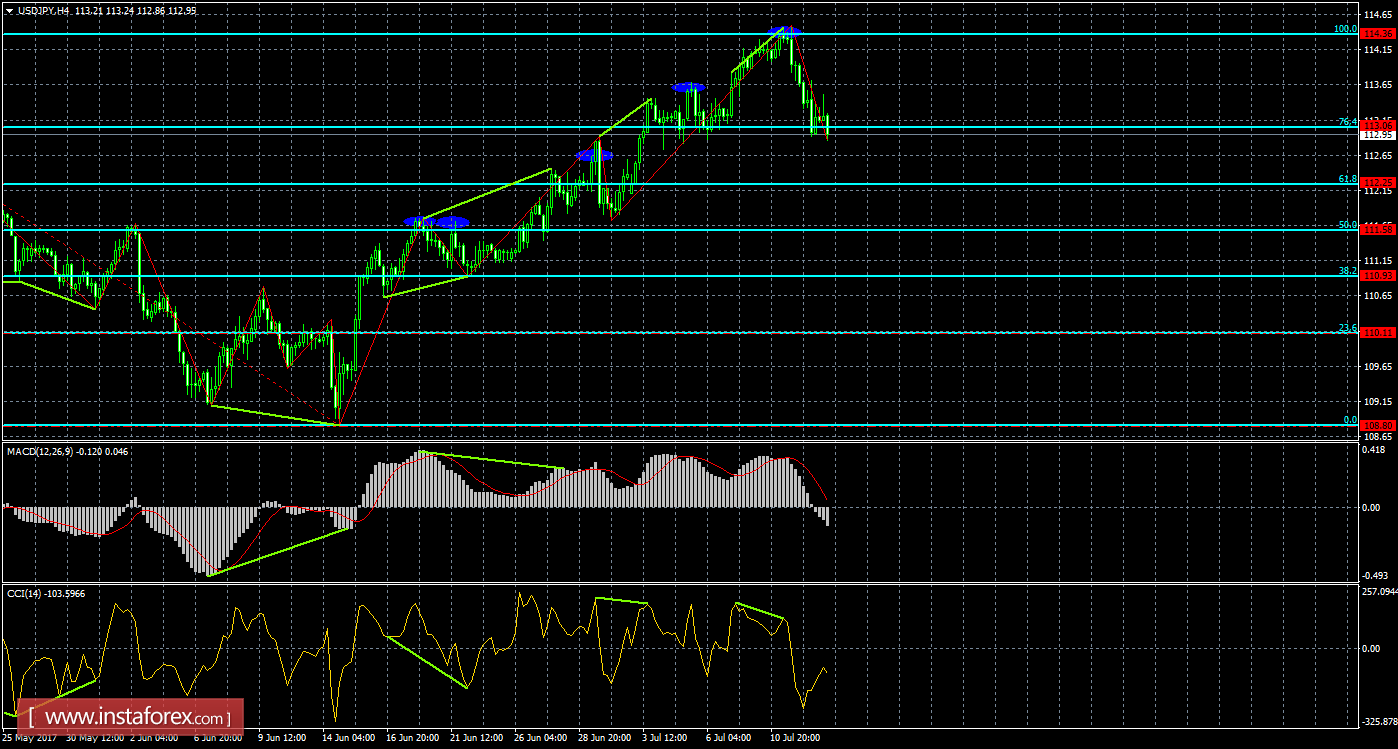

4h

As the price rebounded from the correction level of 100.0% - 114.36 and formed a bearish divergence, the USD/JPY moved downwards through the correctional level of 76.4% - 113.06.

A reversal from the Fibo level of 76.4% allows traders to expect a rally in favor to the US dollar and a slight increase towards the correction level of 100.0%. Prices consolidated under the Fibo level of 76.4% will work when the correction level of 61.8% declined. There are no emerging divergences on July 13.

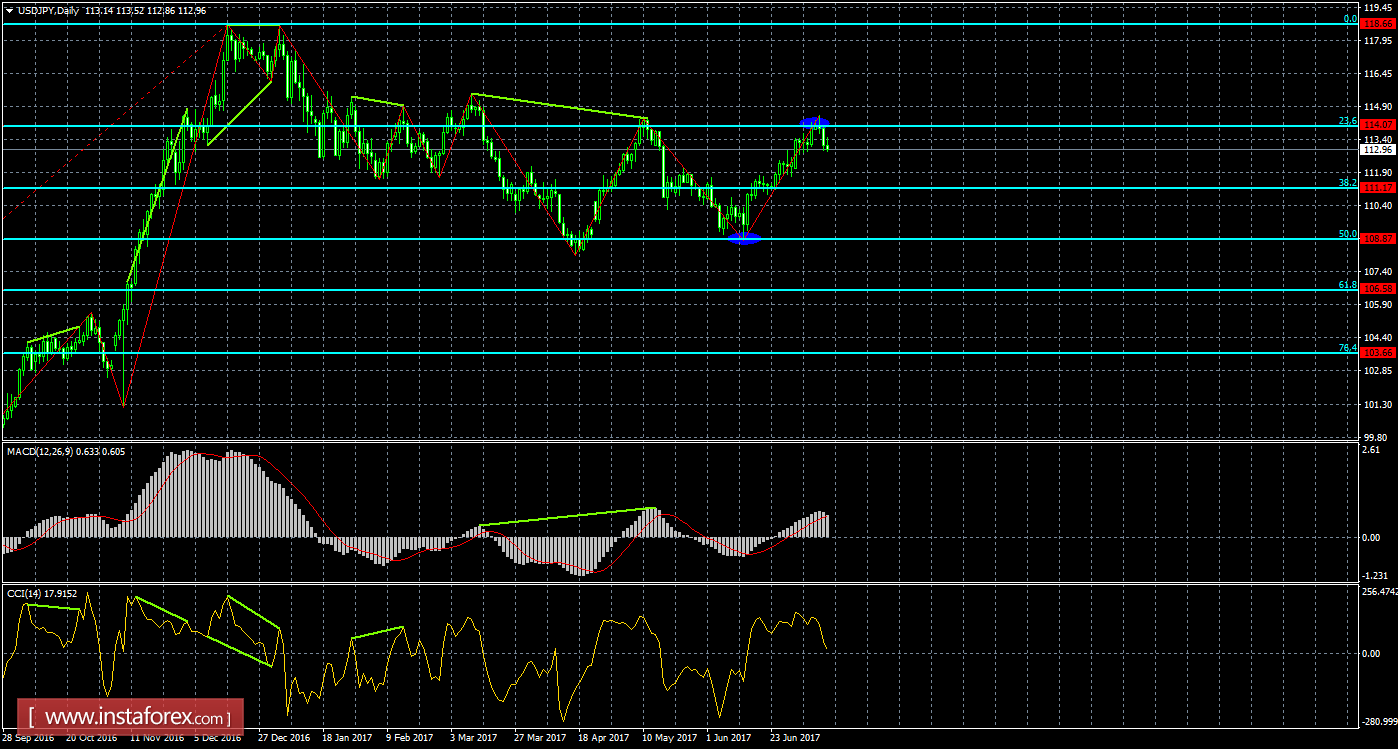

Daily

As shown in the 24-hour chart, the pair pulled back from the correction level of 23.6% to 114.07 which could lead to a reversal towards the Japanese currency. This also resulted in a downtrend towards the direction of the Fibo level began 38.2% - 111.17. There are no emerging divergences seen in any indicator. The prices are fixed above the correction level of 23.6% which is favorable to the US currency and the growth continues through the Fibo level 0.0% - 118.66. The pair's retracement from the correction level of 38.2% will work similarly with an earlier uptrend.