The speech of the head of the Federal Reserve, Janet Yellen, before the US Congress on Wednesday showed that she maintained the general rhetoric of the bank which is the desire to normalize the monetary policy, increasing the likelihood of a pause in raising interest rates for this year and next year.

The most important words in the speech of Janet Yellen was the shift in the vector of assessing the prospects for further rate hikes. This will depend on the dynamics of inflation which incidentally, has recently shown a slowdown. Because of this, the markets are compelled to think that not only will rate hikes be slower in the future causing an overall decrease in relation to the pre-crisis but also that there'll be more pauses in raising rates this year.

If Yellen tried to be very reserved in her speech before the Congress, the Federal Reserve representative, Esthel George was the opposite. George commented on the economic situation of the country and was more open and assertive compared to Yellen.

She expressed fear that "the current position of the Fed can provoke financial imbalances." She also noted that "financial instability can arise unexpectedly, and that it is necessary to observe vigilance in relation to financial markets." She was categorical in her statement, saying that "it is necessary to continue the gradual increase in rates." The Fed representative also expressed bewilderment on as to why the financial conditions are still soft. The rhetoric of George reflects the current mood in the central bank. This is something that Yellen will also have to consider.

Today, the focus of the market will be the important data on the inflation in the US. The values of the producer price index (PPI) will also be released. It is expected that the value of the annual indicator will decrease to 1.9% from 2.4%. Meanwhile, the monthly indicator will also show a decline of 0.1% in June from May's results. If the data comes out in line with expectations or even worse than expectations then it will undoubtedly put pressure on the dollar again, leading to further sales. At the same time, if the figures are positive and show growth, then when can expect a local recovery of the US currency.

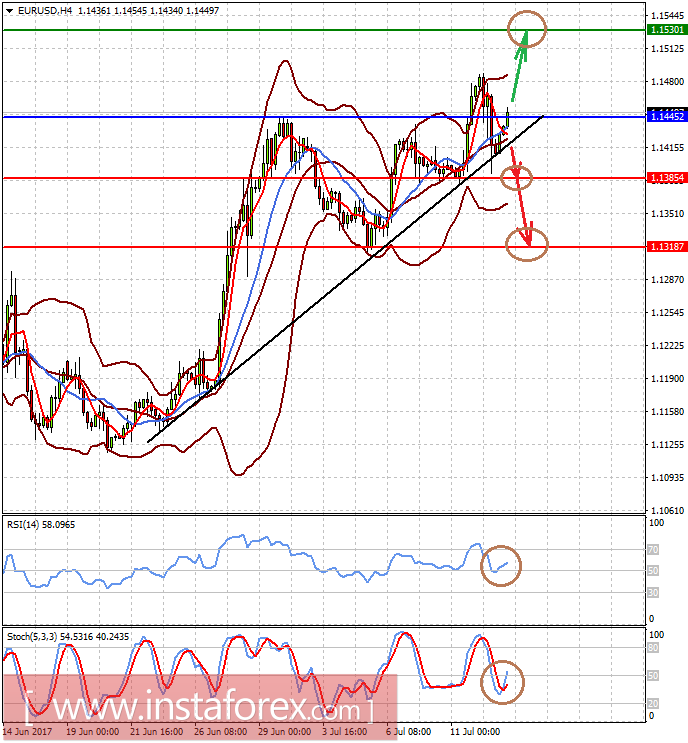

Forecast of the day:

The EUR/USD currency pair remains in the short-term upward trend on the wave of the general weakness of the dollar. If the data on producer inflation are no better than expectations, the pair may grow to the range of 1.500-30. However, if the figures are positive, there is a possibility of a decrease to 1.1385 and 1.1315-20.

The USD/CAD currency pair fell significantly to new local lows on the wave of the Central Bank of Canada's decision to raise rates by 0.25%. However, from a technical point of view, the pair is heavily resold. Positive news from the US can turn it up to 1.2780 or even to 1.2850-55.