Data on consumer price inflation in Germany did not support the European currency, as it was fully in line with economists' forecast.

Given the fact that the data was in line with expectations, a new trend in relation to the buying of the European currency, which was observed at the Asian session, was not formed.

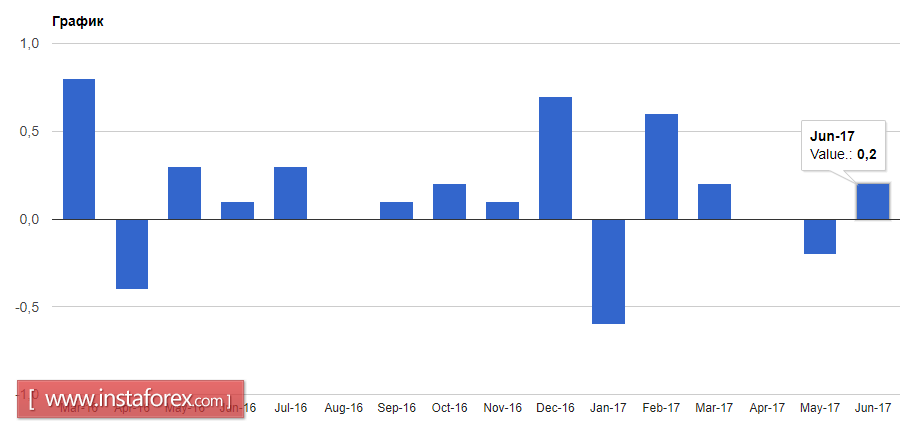

According to the statistics agency, the final consumer price index of Germany in June this year increased by 0.2% compared with May.

Core inflation, which excludes the volatile categories of goods, also increased.

Today, there were talks in the market that in August ECB President Mario may express the strengthening of the central bank's confidence in the eurozone economy, which could weaken its dependence on monetary stimulus.

If the future of the current stimulus program , under with the ECB buys assets worth

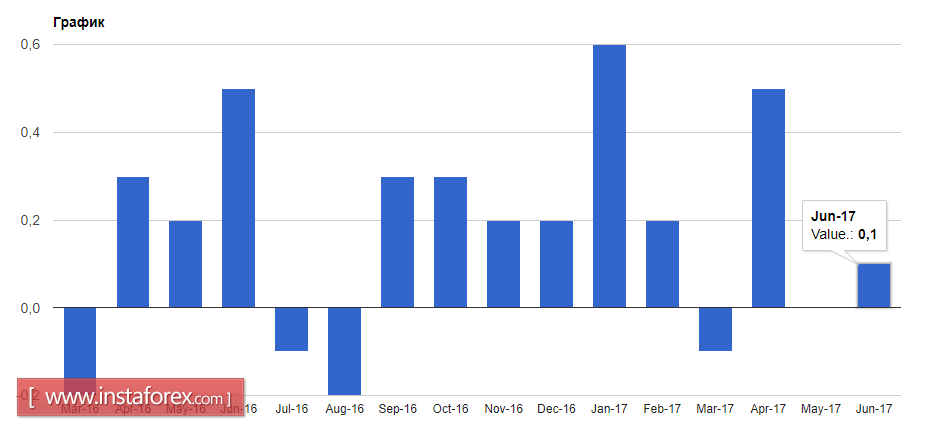

In the second half of the day, the data on US inflation was released, which was slightly different from the forecasts of economists.

According to a report of the US Department of Labor, the indicator for the final demand in the US rose in June, indicating a moderate increase in inflationary pressure in the economy.

In general, the technical picture in the EURUSD pair remains on the side of the US dollar buyers, and will depend much on what the chairman of the Federal Reserve Janet Yellen says, since it is her remarks that will determine the future direction in the trading instrument.

A break of support at 1.1380 resume sales on EURUSD, which will lead to the renewal of 1.1330 and 1.1250. The return to the level of 1.1420 will serve as an opportunity to build new long positions in order to return to monthly highs in the 1.1500 area.