The Weak inflation data in the US and the decrease in the consumer sentiment indicator, put more pressure on the U.S. dollar which fell significantly along with the British pound and euro by the end of the week.

Positive indicators of the budget surplus of Greece also pleased investors on Friday night.

According to the Ministry of Finance, Greece's budget primary surplus worth EUR 1.94 billion in the first 6 months of this year. This figure is significantly higher than the target level of 431 million euros. As stated in the report, this level has been achieved primarily through spending cuts. The Greek Finance Ministry also reported that the country's budget revenues for the first half of the year amounted to 22.17 billion euros, while budget expenditures reached 23.77 billion euros.

A weak data of the consumer sentiment from the US has disappointed investors. This indicator decreased for the second month in a row, which is an alarming signal for the Central Bank as consumers are losing hope that the new economic policy of the White House will lead to faster economic growth.

According to a report from the University of Michigan, the preliminary index of consumer sentiment fell to 93.1 points in July this year against 95.1 points in June. Economists had expected the preliminary index to be 94.7 points in July.

The attention of traders for this week will focus on the meeting of the European Central Bank, the results of which will be known this Thursday. It is expected that the key interest rate will remain unchanged, although many market participants expect the head of the ECB to understand the issue on stimulus reduction was deliberated on.

As for the technical picture of EUR/USD pair, buyers earlier this week will focus on the renewal month highs near 1.1500. The return to a massive resistance level of 1.1470 confirms the continuation of the upward trend for the euro. Fixing below 1.1440 can initiate buyers to stop orders, which could lead to a deeper downward correction to the range of 1.1400.

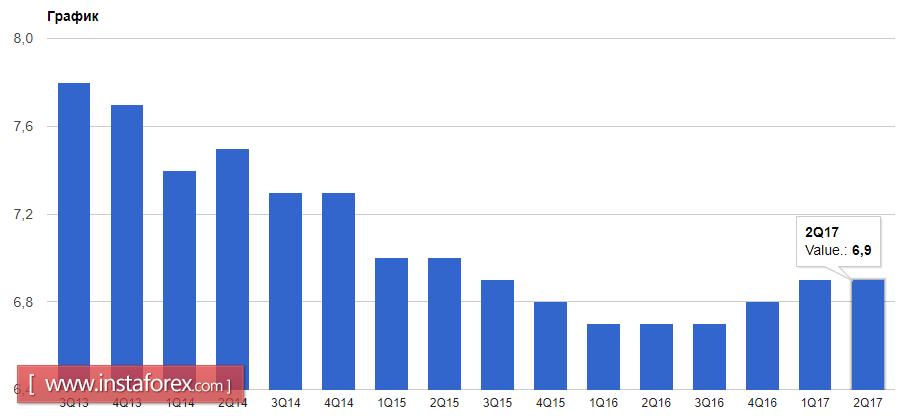

Commodity currencies ignored data on the growth of China's economy in the second quarter of this year.

According to the report of the National Bureau of Statistics, China's GDP grew by 6.9% compared to the same period last year in the second quarter of 2017. A similar growth was observed in the first quarter of this year. Economists expected that GDP will grow by 6.8% compared to the GDP growth in the previous quarter of 1.7%.