EUR / USD, GBP / USD

On Monday, the British pound lowered down by 42 points after an interview with Finance Minister Philip Hammond about the break with the European market after Brexit.

This morning, the dollar began to weaken sharply due to headlines about the split in the Republican Party on voting about changing the health insurance program (Obamacare) - a number of Republican senators said they would not vote for the amended bill passed by the House of Representatives.

The macroeconomic news is expected to worsen the inflation.

Today, the euro area is also expected to weakened indicators.

In the US, the business activity index in the housing market from NAHB for the current month is expected to remain unchanged by 67 points.

USD / JPY

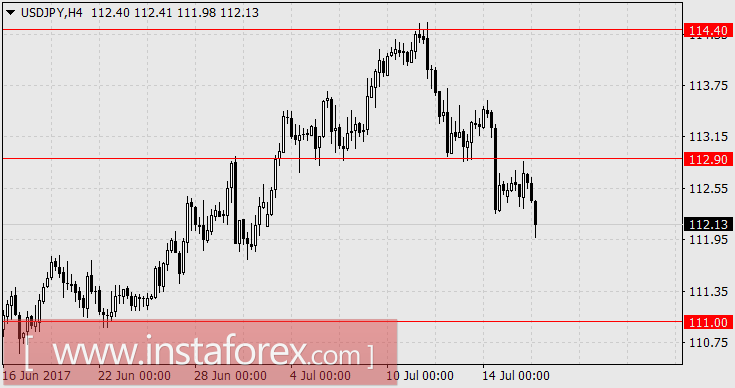

Unfortunately, the yen failed to reach the resistance level of 114.40 and remained under pressure of the global weakening of the dollar which fell to 112.90. The stock market set the yen "stepping stone" - the S&P 500 decreased by 0.01% in total Monday

Currently, the monthly period of quarterly corporate reporting has passed, and in general, the results are shown to be good. Friday was excellent - banking giants Citigroup, Wells Fargo, JPMorgan Chase showed a profit above forecasts. On Monday, 10% of reporting companies also showed a better profit than expected and today good forecasts for Johnson & Johnson (profit 1.80 dollars per share vs. 1.74 dollars a year ago) and Bank Of America (0.43 dollars per share against 0.41 last year).

We are looking forward for continuous growth on the US stock market and with the growth of the USD / JPY pair. While during the Asian session, all indices are down as the Nikkei 225 lose 0.63%. Further loses in profitability and Japanese government bonds.

The current pressure may continue until Thursday, the same day where data on Japan's trade balance for June (forecast 485 billion yen against -203 billion in May) and the decision of the Bank of Japan on monetary policy will be released along with the report on the outlook for the economy. We do not tolerate the thought that in the current situation (after a heavy climb from 108.70, see the review of 14.07), BoJ will not support the economy and the national currency will weaken at least verbally. After the correction (it is possible that to 111.00), we are waiting for the price to return to 114.40 and further increase to 115.80.