As a matter of fact, everything will revolve around the pound today. First, inflation data will be published, the rate of which should remain unchanged at 2.9%. This in itself is already good for the pound. However, later in the afternoon the speech of Mark Carney will take place. In light of the rather high inflation, keeping the refinancing rate at 0.25% is not just strange, but even dangerous. This has already led to a divide in the Bank of England, when in the course of the meeting of the policymakers three board members voted to raise the refinancing rate. However, Mark Carney resists and regularly says that it is too early to hike lift the refinancing rate. But when inflation stabilizes around 3.0% and almost all the forecasts indicate further growth, the desire to continue to stick to such a loose monetary policy is not just a surprise but also a fear.

If the head of the Bank of England changes its rhetoric and declares the need for the normalization of the monetary policy, interest in the pound will rise significantly. Otherwise, the negative consequences for the pound can be quite serious.

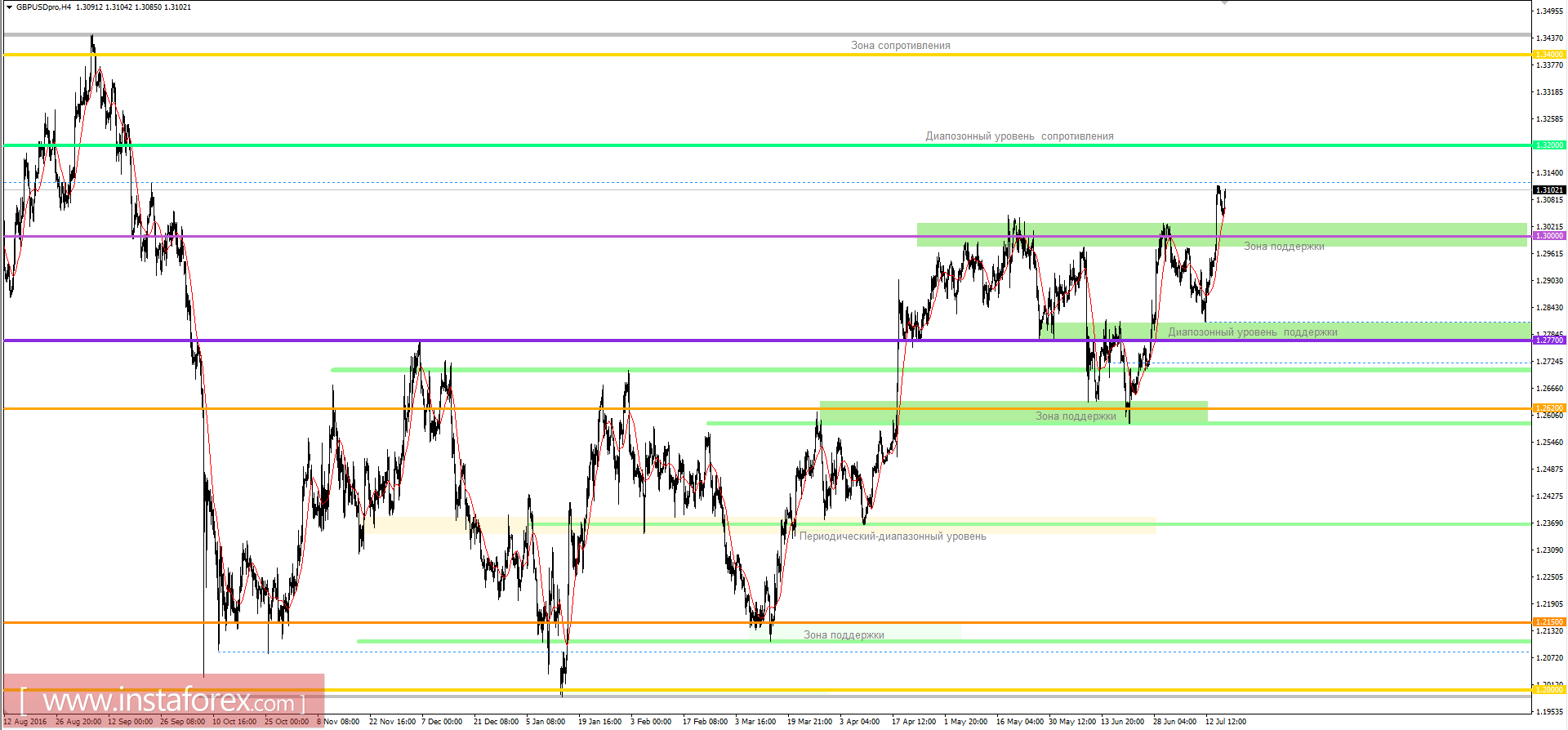

If a potential increase in the refinancing rate is announced, the pound will rise to the values of 1.3150/1.3200. If Mark Carney continues to resist, then the pound will once again return to the range level of 1.3000 (1.3030 / 1.2980).