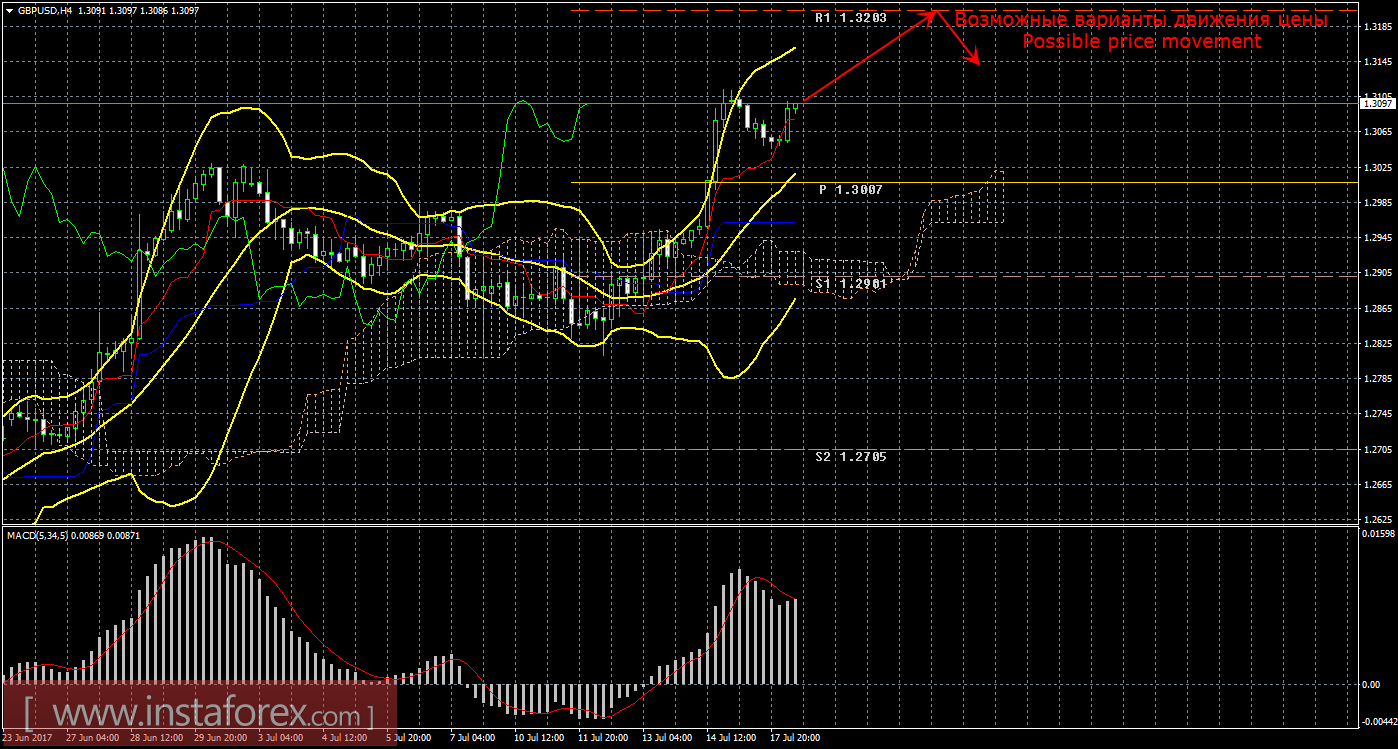

4-hour timeframe

The amplitude in the previous day (high-low): 66 points.

The distance of the last day: 85 points.

The exchange rate of the GBP / USD pair began correction on July 18, but the correction is quite weak and can be completed in the next few hours.

Trading recommendations:

Pound on the Forex market is recommended to consider long positions with targets of 1.3203 and 1.3309. The T/P can be set slightly below the target levels. The stop loss order is recommended to be placed below 1.2960. When the transaction is about to reach the profitability of 60-100 points, it can be transferred to break even. It is recommended to open new buy-positions in the case of a price rebound from the critical line or when the MACD indicator turns upward. From the UK, the consumer price index is expected today (08-30 GMT) and Mark Carney's speech will be held today (13-30 GMT). On the other hand, in America, the import price and export price indices will be released today (12-30 GMT). Thus, these major news will influence the technical aspect for today.

Aside from the technical aspect, traders should also consider the fundamental data and their scheduled releases.

When there is a possibility to open deals in advance, switch to the smaller timeframe (M15-M30) and monitor the reversal of the trend indicators (e.g. Heiken Ashi) considering the price level and the possibility for a pullback.

Explanation of the picture:

Ichimoku:

Tenkan-sen - red line.

Kijun-sen - blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple stipple line.

Chinkou Span - green line.

Bollinger Bands indicator:

3 yellow lines.

MACD indicator:

The red line and the histogram with the white bars in the indicators window.