Richmond Fed president, Thomas Barkin, remarks in a WSJ interview

Fed will need to continue to provide significant, sustained support

- Economy faces a slowing labour market recovery

- Coronavirus pandemic has proven harder to contain than expected

- Expects employment growth to lag behind spending

- Says keeping rates lower for longer could invite 'risky' behaviour in markets

- But now isn't the time to worry about those hazards

The remarks on the slower recovery aren't anything new but certainly sets up a renewed focus on labour market data, particularly after Powell's speech from last week.

This week's jobs report may not offer much indication of anything new but considering the market focus, it will be the key risk event to watch ahead of the weekend.

Further Development

Analyzing the current trading chart of EUR/USD, I found that EUR got strong supply and the both our targets from yesterday at the price of 1,1925 and 1,1875 are reached.

I still see downside movement towards the third target at 1,1773 and selling on the rallies is good strategy under current condition.

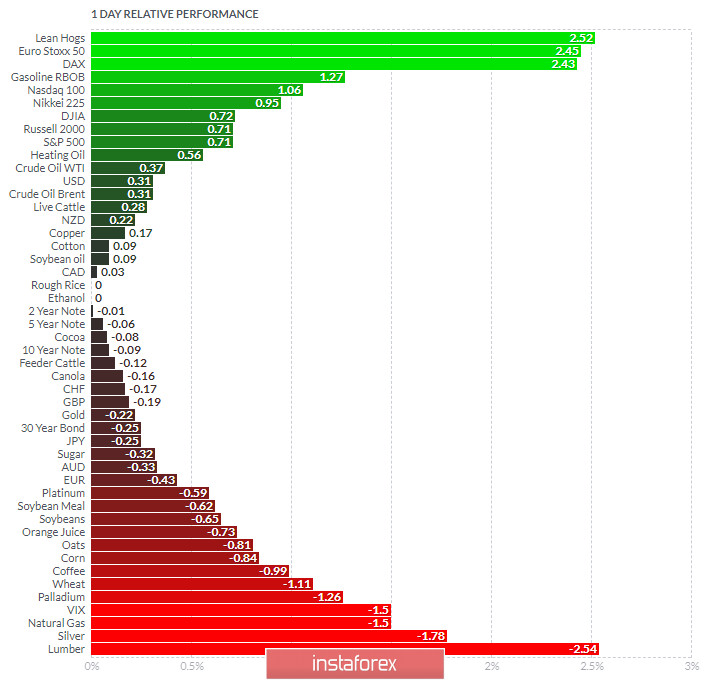

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Lean Hogs and Euro Stoxx 50 today and on the bottom Lumber and Silver.

EUR is on the bottom of the list with no evidence of reversal.

Key Levels:

Resistance: 1,1890

Support level: 1,1775