GBP / JPY

The upside targets remains at 148-149 (the maximum extremes of past corrections 148.08-43 and the target for the breakdown of the daily cloud), but on the daily timeframe, as well as the weekly, the setting for the hidden bearish divergence for Chinkou have been formed. Therefore, the transition to the side of bears within the daily short-term trend (Tenkan 146.50) will likely allow a corrective decline which are the main targets, except for daytime levels (Fibo Kijun 144.41 + Kijun 143.38). This will serve the levels of the weekly gold cross Ichimoku (Tenkan 143.20 + Kijun 141.83). Update 147.75 (maximum daily divergence) - cancel the daily divergence, rise above 148.08 (maximum weekly divergence) - cancel the weekly divergence.

Currently, the support of 146.50, combining the levels of different time intervals is important.

Additional resistance can be seen at 147.10 (Tenkan N4 + Kijun N1 + top of the cloud H1).

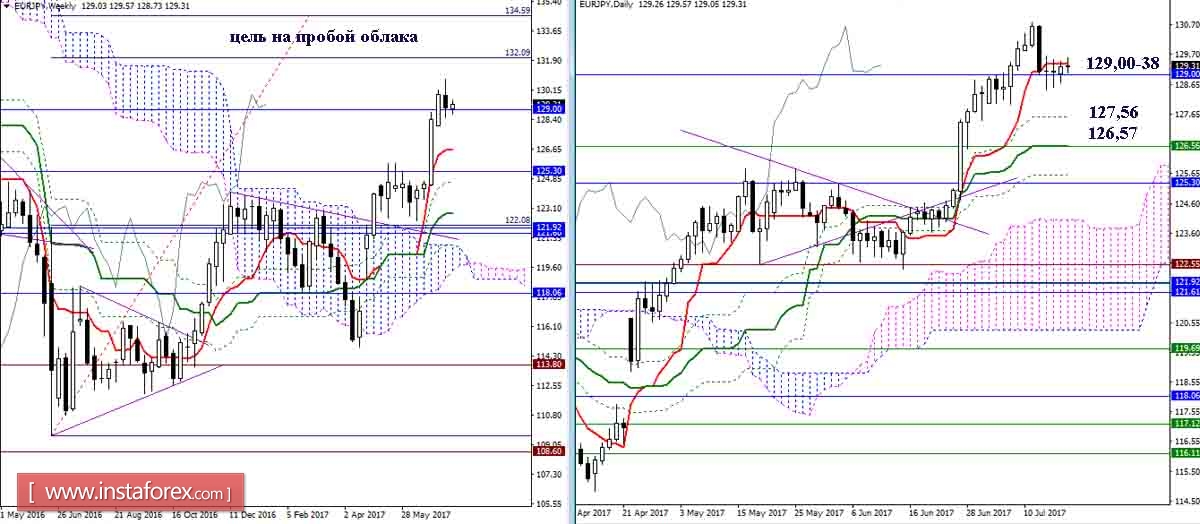

EUR / JPY

The pair continues to be in the sphere of influence of the monthly Fibonacci Kijun (129) and the daily Tenkan (129.38).

The cloud H4 (129,10-90) continues to serve as the center of gravity, the cloud strengthened the levels of the high seasons (129,00-38).

Indicators:

All time intervals 9 - 26 - 52

The color of the indicator lines:

Tenkan (short-term trend) - red

Kijun (medium-term trend) - green

Fibo Kijun - green dotted line

Chinkou - gray

Clouds: Senkou Span B (SSB, long-term Trend) - blue, Senkou Span A (SSA) - pink.

The color of additional lines:

Support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray

Horizontal levels (not Ichimoku) - brown

Trend lines - purple.