Latest data released by Eurostat - 2 September 2020

Prior +0.7%

- PPI -3.3% vs -3.3% y/y expected

- Prior -3.7%

Producer prices improved slightly in the month of July, but this is very much a lagging indicator as we already saw the kind of deflationary pressures on inflation in the euro area for the month of August yesterday here.

The downside risks posed by weaker inflation in the next few months could potentially turn into a major headwind for the euro and will be a key spot to watch.

Further Development

Analyzing the current trading chart of Gold, I found that Gold rejected of the strong pivot resistance at the price of $1,975 and confirmed downside rotation probably towards the support at $1,912

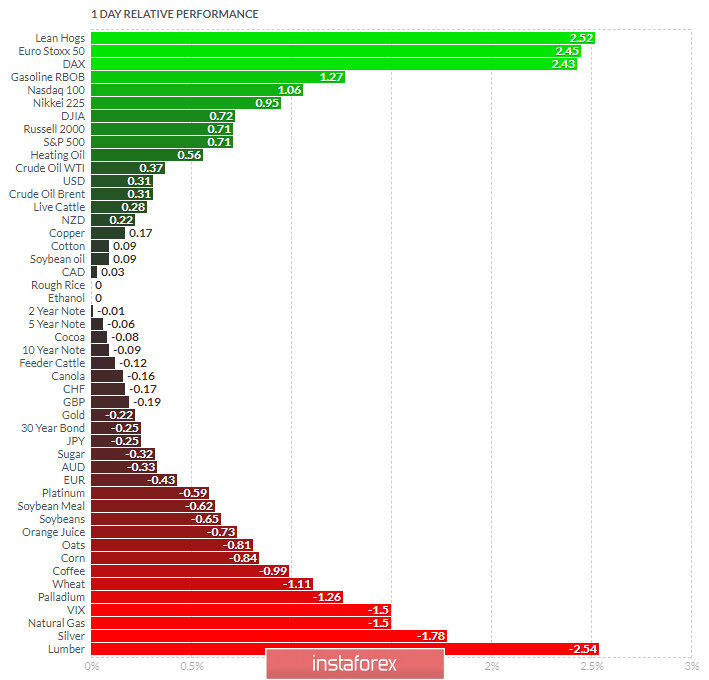

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Lean Hogs and Euro Stoxx 50 today and on the bottom Lumber and Silver.

Gold is on the negative territory with no evidence of reversal yet.

Key Levels:

Resistance: $1,975

Support level: $1,912