The overall picture: Trend against the dollar, but still waiting for the ECB on Thursday.

In the market, there is a shortage of important news. The main event is tomorrow, July 20, the ECB's decision on monetary policy. Markets are waiting for cautious statements from the ECB about the beginning of a turn to a balanced policy and the curtailment of liquidity injections. Actually, the strong growth of the EURUSD exchange rate recently had been building a foundation for this movement of the ECB. At the same time, ECB doesn't desire to see a sharp surge in yields and a new jump in the euro exchange rate as a result of its statements. On the other hand, postponing the decision can lead to an even more undesirable result in the future.

So, we are waiting for the decision of the ECB on Thursday.

At the same time, the euro was close to the maximum long-term of 2-years! Range is within the zone of 1.1615 - 1.1670. The entry points are not very attractive and the growth potential is small.

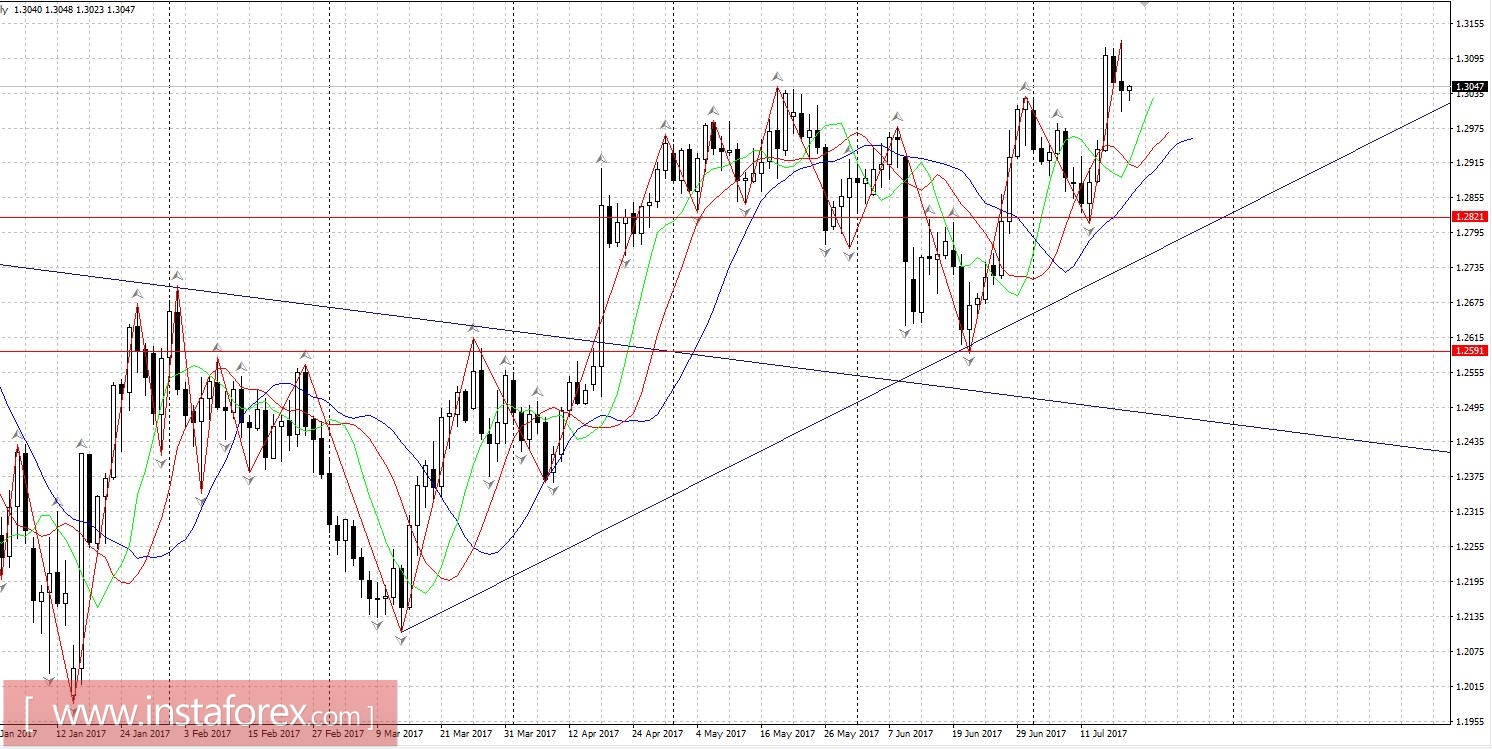

EUR / USD

Upward trend. Purchases from rollback. Rollback is possible up to 1.1440

USD / CHF

The rate broke down an important support level of 0.9550. This is a strong signal for a downward movement.

GBP / USD

Purchases from rollback up to 1.2900.

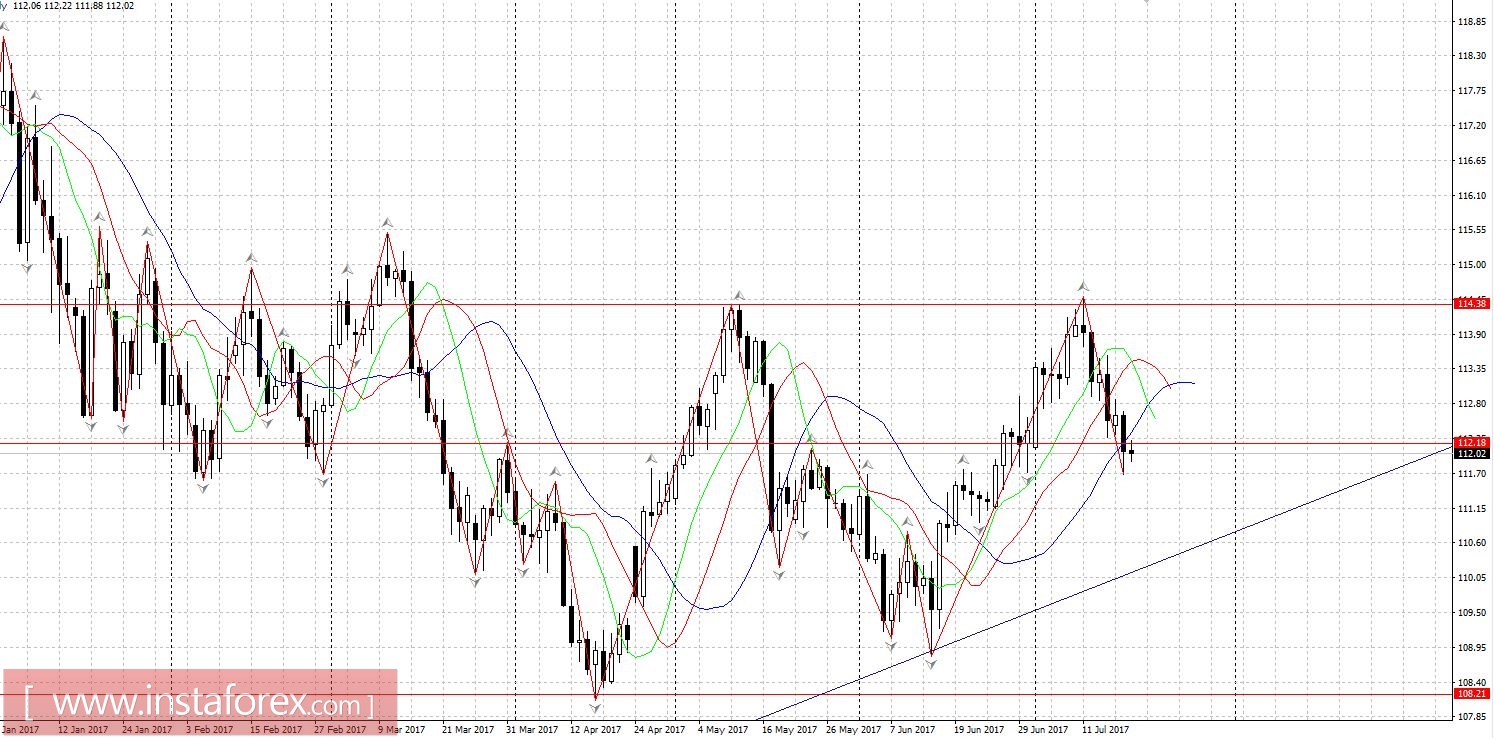

USD / JPY

The yen strongly opposes the general movement against the dollar. Buying the USD / JPY rate still makes sense. If you want to play "for the dollar" dollar-yen rate, your choice, our opinion.

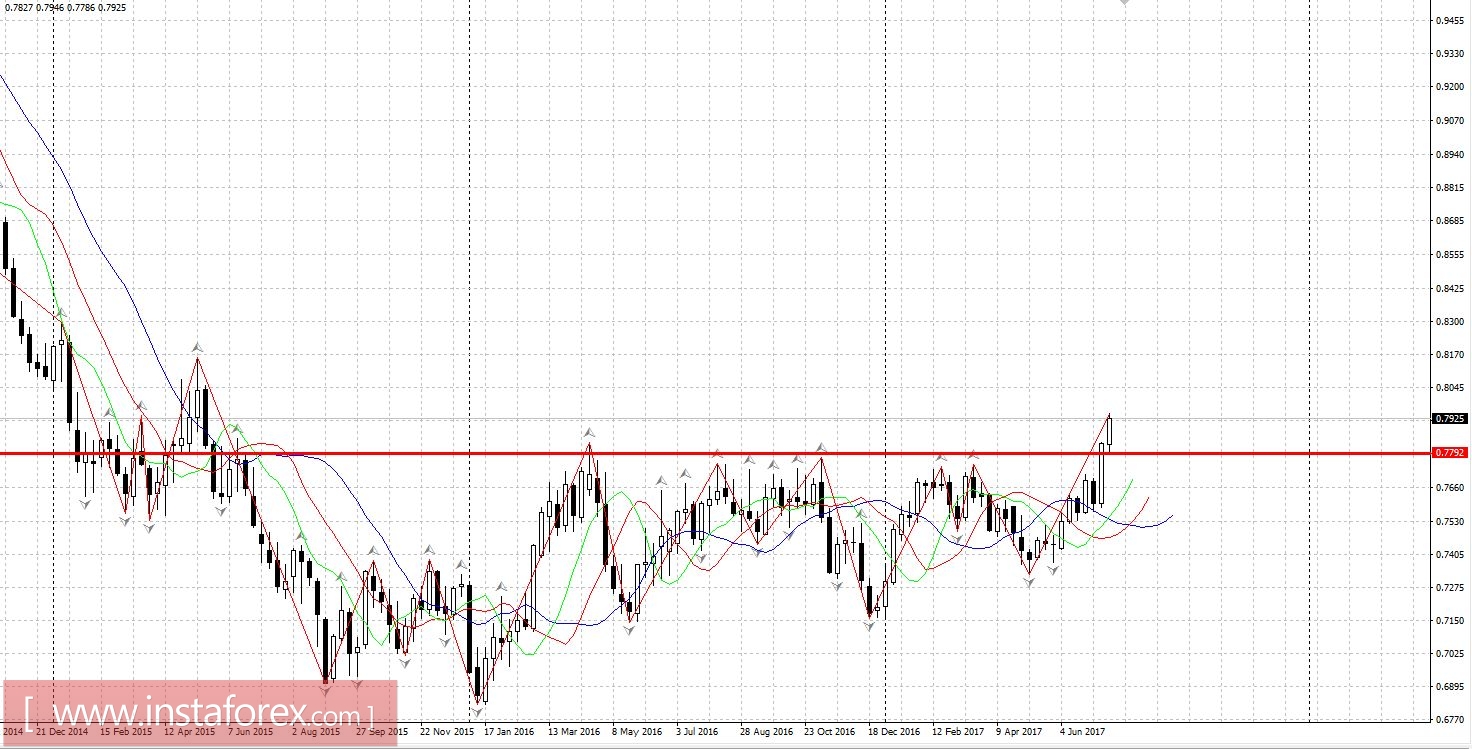

P.S. Pay attention to the growth of AUD / USD. There is a great potential for continuation.

(This is a weekly chart!)