The gold futures rebounded and the main factors were the moderately dovish rhetoric of Janet Yellen, disappointing statistics on US inflation and retail sales, the first time since 2010 China's GDP growth of 6.9% in the second quarter and the closure of short positions.

The key driver of the XAU / USD rally was the weakness of the US dollar.

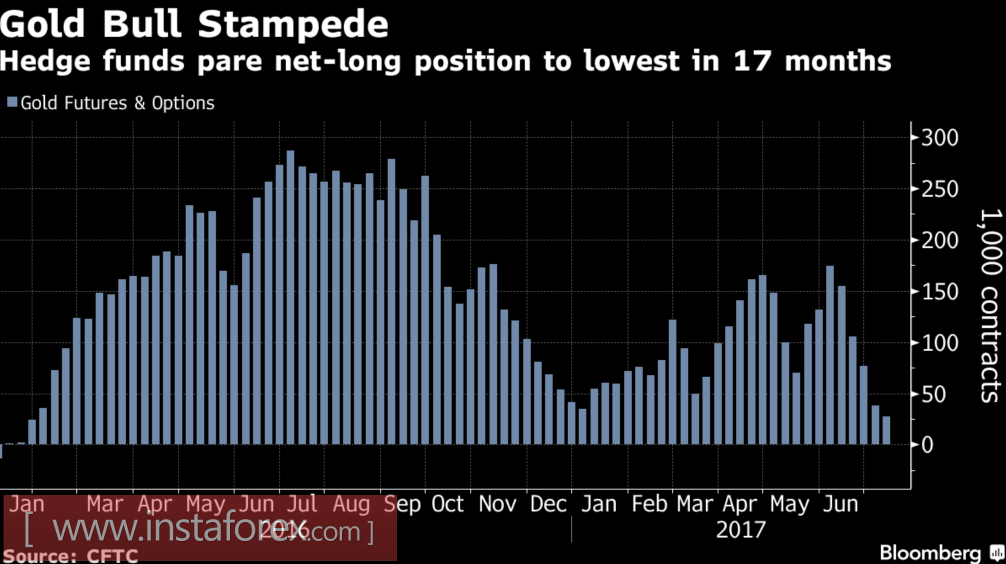

An important factor in the XAU / USD rally was the change in the mood of major players.

The dynamics of speculative positions in gold

Source: Bloomberg.

Subsequent events showed that speculators were mistaken. In an effort to correct an oversight, hedge funds began to return to the market and some of the recorded profits on short positions were supported by XAU / USD.

In the short-term perspective, the fate of gold will depend on the success of passing the bill on budget reform through the US Congress and the content of the negotiation between Washington and Beijing over trade cooperation. Additionally, the new macroeconomic statistics on the US political risks, the risks of protectionism and the slowdown in global GDP, coupled with the state of the US economy's health are important drivers of change in the value of precious metals.

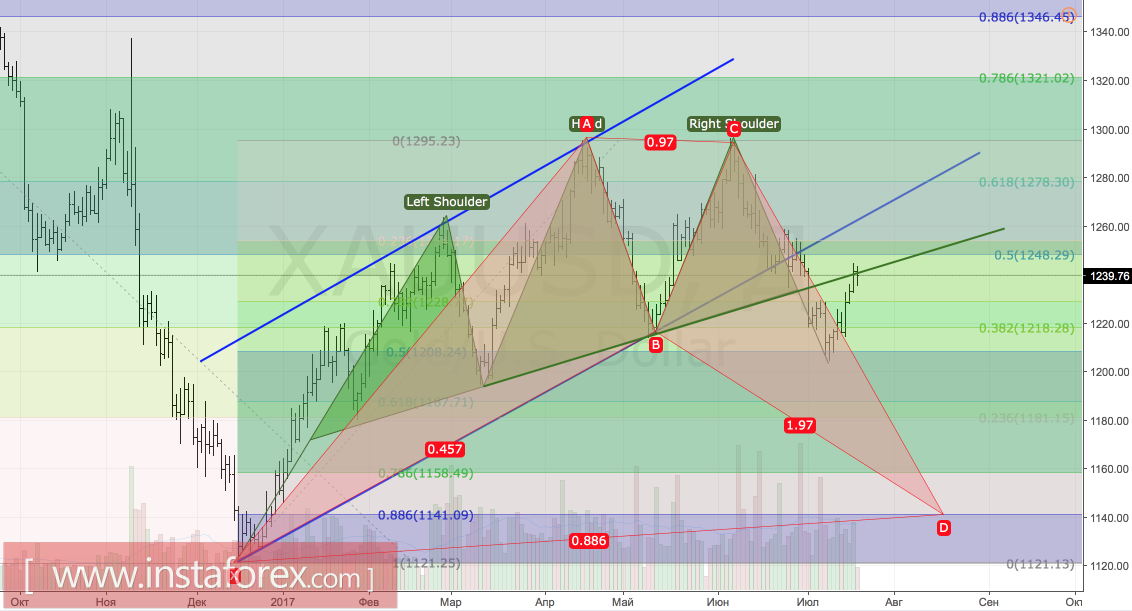

Technically, XAU / USD quotations moved back to the neckline of the "head and shoulders" pattern. A break in the diagonal resistance increases the risk of continuation of the Northern Expedition directed to $1,265 and $ 1,280 per ounce. On the contrary, the rebound followed by a successful test of support at $1,228 will allow the "bears" to return the lead.

Gold Daily Chart