The Canadian dollar continued to move higher against the US dollar after the release of positive fundamental data which indicates sales growth in the manufacturing sector.

According to the report of Royal Bank of Canada, supplies in the manufacturing sector in May this year rose by 1.1%, amounting to 54.59 billion Canadian dollars.

Economists expected an increase of 0.8%.

As mentioned above, the commercial oil reserves data caused the "black gold" to step up in the afternoon.

The petroleum reserves also decreased, showing a reduction of 4.4 million barrels to 231.2 million barrels, as the economists predicted a downswing in gasoline stocks by 600,000 barrels.

Distillate stocks fell by 2.1 million barrels to 151.4 million barrels.

This data was strongly supported by oil prices which moved back towards the significant level of resistance at $47 by WTI. Breaking this range will lead further growth with the renewed monthly highs around $ 48.40 per barrel.The Bank of Japan decided to leave interest rates unchanged which put pressure on the Japanese yen and fell slightly against the US dollar during the Asian session today.

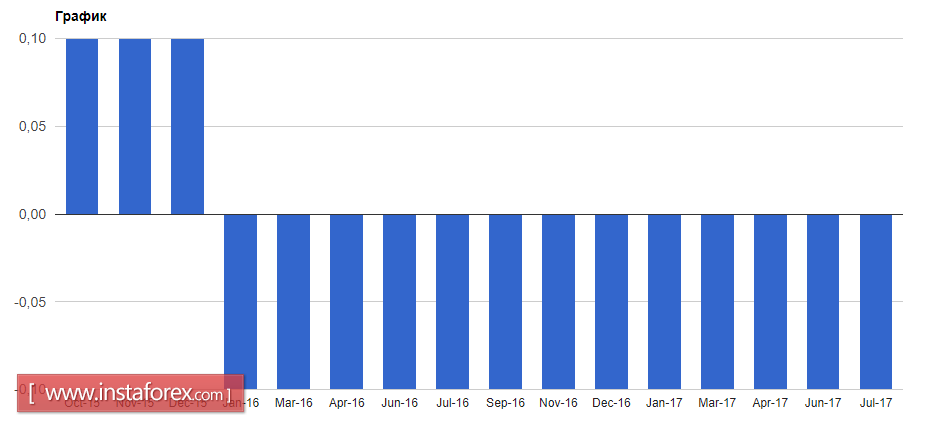

The Bank of Japan decided to leave interest rates unchanged which put pressure on the Japanese yen and fell slightly against the US dollar during the Asian session today.

The Bank of Japan kept the deposit rate at the 0.1% level, as well as the obligation on government bond purchases at a rate of 80 trillion yen per year.

The data on export growth from Japan were ignored by the market, although they came in better than forecasts of economists.

Japan's foreign trade surplus in June was 439.9 billion yen, while economists expected a surplus of 488 billion yen.