As expected, the Bank of Japan left the interest rate levels, as well as the terms of the asset repurchase program, unchanged. This was expected by the markets, and therefore investors had no special reaction. The main focus today will be drawn to the results of the ECB's two-day meeting on monetary policy.

Three weeks ago, M. Draghi encourage the financial markets with a statement, though not quite certain, but rather optimistic, that next year the termination of the quantitative easing should be expected in the wake of to the positive condition in the eurozone economy. In the aftermath of that not entirely definitive statement, the market decided that the lack of government bonds to purchase, primarily Germany, for the implementation of the quantitative easing program, as well as the positive dynamics of the eurozone economy, will have to force the ECB to announce the end of the program of monthly asset purchases of 60 billion euros.

Against this background, the single currency rallied primarily against the U.S. dollar for three weeks and the current fourth week also recorded an increase. In many ways, the increase in the main currency pair was provided by the weakness of the U.S. dollar, but a significant role in this was also played by a change in sentiment and expectations in the markets.

Investors believe that the result of the ECB meeting will be the announcement about stopping the buying of government bonds from the start of 2018, and, perhaps, even the beginning of the gradual increase in interest rates. This scenario is also already perceived and priced in by the markets, including the euro against the currencies in the foreign exchange markets.

Assessing such sentiment, as well as the state of the European currency and a weak inflation rate that is at an annualized rate of 1.3%, which is significantly below the 2.0% target level, and it is believed that the European regulator will announce a gradual decrease in the asset purchases, rather than definitive termination. It can also be said that the bank will tie this event to the incoming economic data, and first of all to the dynamics of inflation. Against the backdrop of such decision by the central bank, as well as the general meaning of comments by President M. Draghi, who is likely to be cautious of his statements, the single currency will continue to be adjusted downwards.

Forecast of the day:

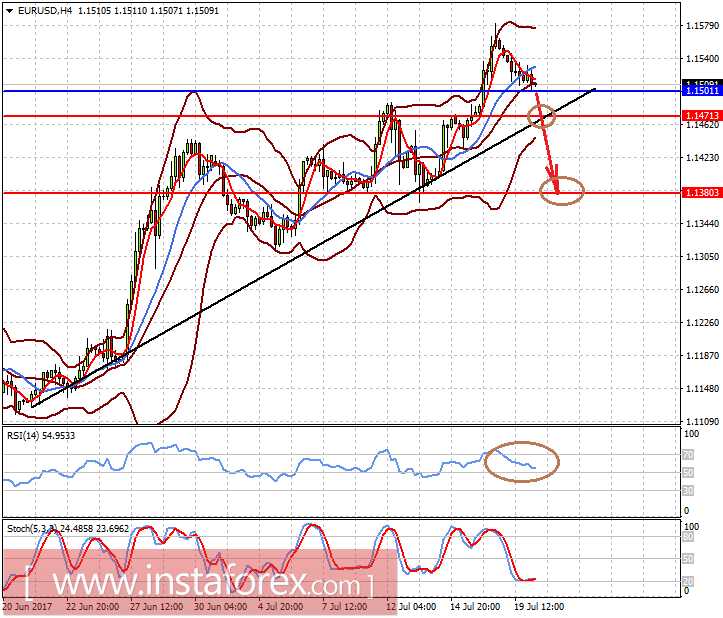

The pair EURUSD is trading above the level of 1.1500 in anticipation of the outcome of the ECB meeting on monetary policy. If the outcome of the meeting is not in line with market views and will show a more cautious position of the regulator regarding an abrupt change in the monetary policy, the pair may fall after overcoming the level of 1.1500 to 1.1470 with the possibility of further decline to 1.1380.

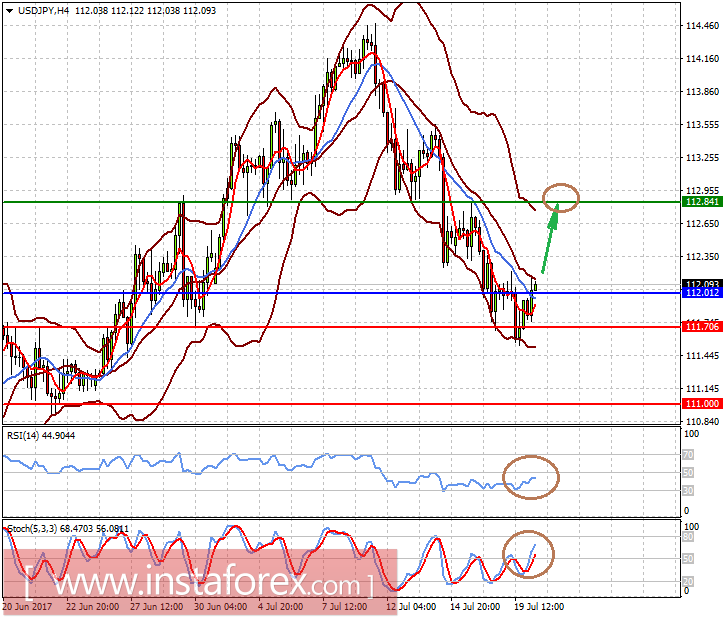

USDJPY is above the 112.00 level. It can continue to grow further if the ECB also remains cautious in wanting a sharp change in the economic course. At this wave, the price may rise to 112.85.