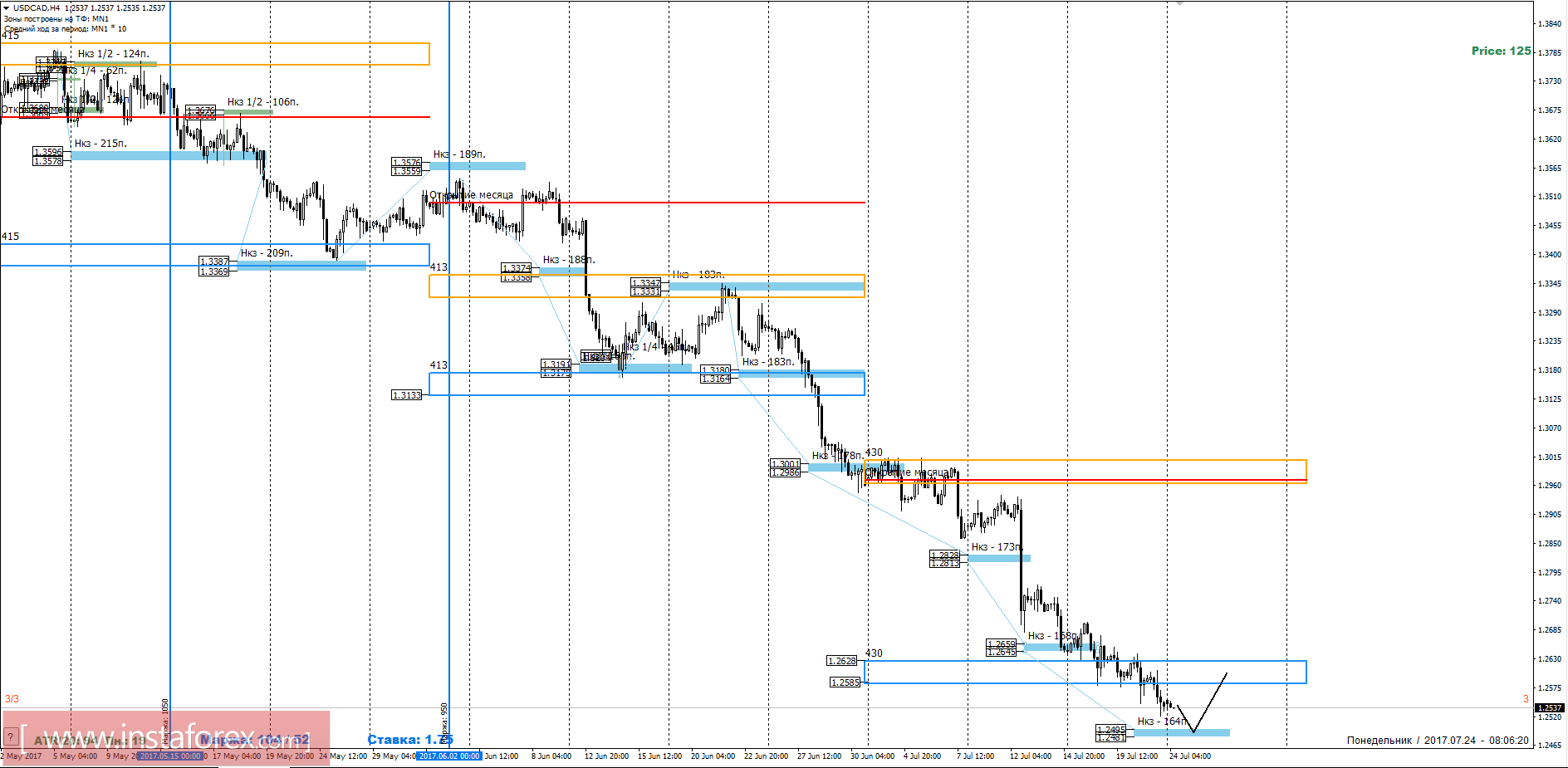

During the entire current month, the pair continues to form a downward impulse movement. The monthly short-term fault of 1.2628-1.2585 is already broken, which indicates a high probability of a price return.

Medium-term plan.

The downward movement is a strong medium-term impulse. This obliges to search for zones and levels where it would be advantageous to fix part of the position or completely withdraw from the transactions. The closest target is a weekly short-term fault of 1.2495-1.2481. The test of this zone can lead to the formation of a corrective movement, the purpose of which will be a monthly short-term fault. The closing part of the position is the optimal strategy. Such strong impulse movements do not occur often, so one should not underestimate their strength. This implies the refusal to search for purchases until the formation of the reversal model, even if at a younger timeframe.

An alternative model will develop if the pair can grow enough to gain a foothold above 1.2628 by the end of this week. This will allow us to consider the formation of a correctional model of a higher order.

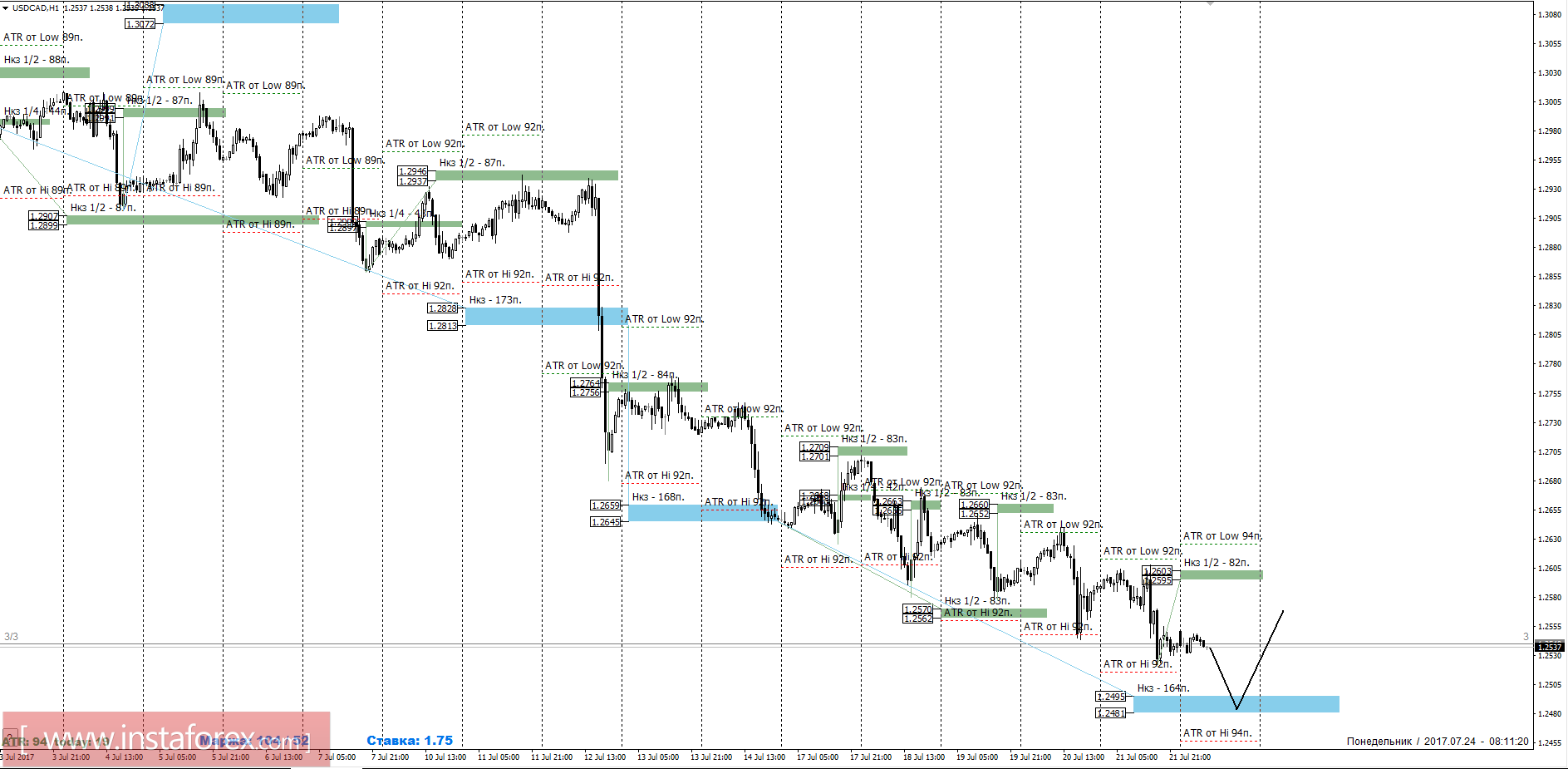

Intraday plan.

Today's traffic implies an update of the monthly minimum, so the retention of sales made last week is the optimal strategy. The search for repeated sales should be made on the younger control zones after the formation of a new monthly minimum. The main purpose of the fall is a weekly short-term fault of 1.2495-1.2481. The test of this zone will close the next batch of short transactions. The search for purchases will become possible only after the breakdown and consolidation above one of the control zones, which are resistances.

Daytime short-term fault is the daytime control zone. The zone formed by important data from the future market, which change several times a year.

Weekly short-term fault is the weekly control zone. The zone formed by important marks of the future market, which change several times a year.

Monthly short-term fault is the monthly control zone. The zone, which is a reflection of the average volatility over the past year.