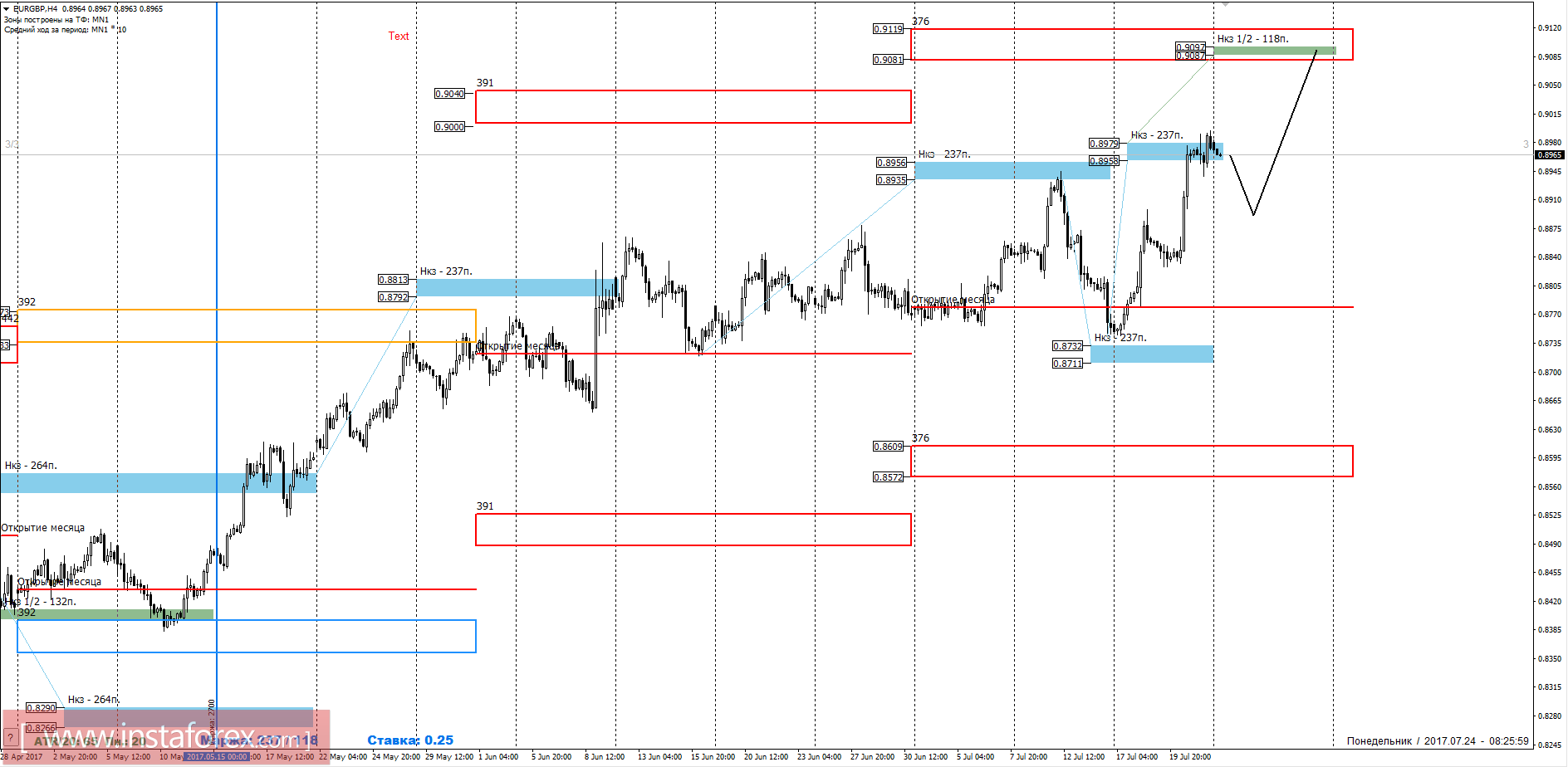

The upward movement last week continued the bullish mid-term trend, which began in May. The weekly short-term fault of 0.8732-0.8711 was expected, so the next growth target can be considered the monthly short-term fault of July.

Medium-term plan.

Pairing above 0.8979 indicates a 70% probability of continuing growth to the next control zone. NKZ 1/2 0.9097-0.9087 is inside the monthly short-term of July 0.9119-0.9081, which indicates its importance. To continue the growth, it may be necessary to form a correctional model, which will allow obtaining favorable prices for the purchase of the instrument, since the pair tested a weekly short-term fault of 0.8979-.08958. Shopping is worth looking for in younger control zones.

For the formation of an alternative model, it will require the absorption of last week's growth and the formation of a reversal pattern on the younger time interval. This will close the remains of purchases and look for sales at the end of this month.

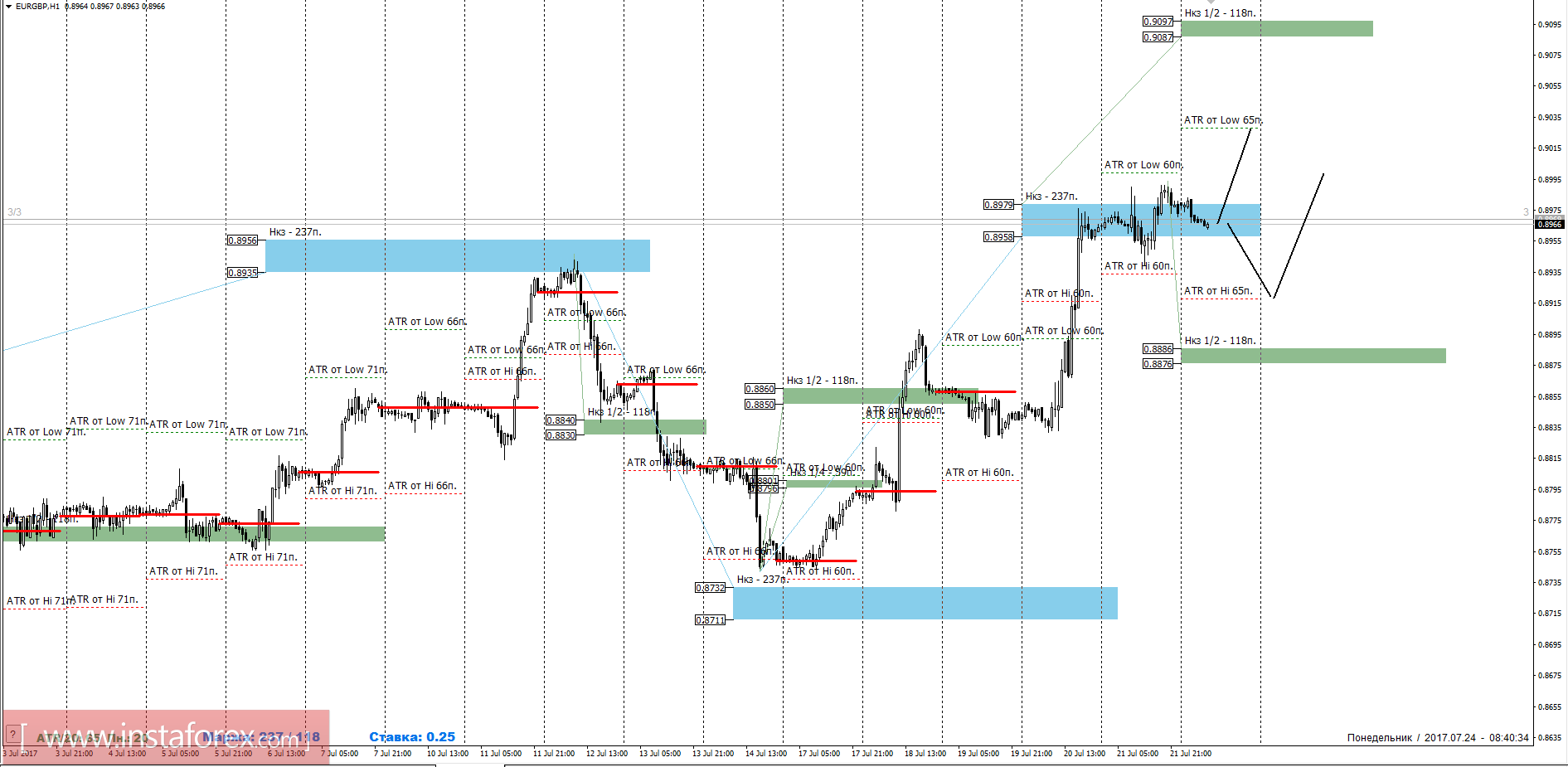

Intraday plan.

A weekly test of 0.8979-0.8958 indicates a possible formation of an accumulation zone or a correctional model. To continue the growth, one of the American sessions above the level of 0.8979 is required. This will open the way for growth to the NKZ 1/2 0.9097-0.9087. The determining support is the NKZ 1/2 0.8886-0.8876. While the pair is trading above this zone, the upward movement will remain impulsive.

Daytime short-term fault is the daytime control zone. The zone formed by important data from the future market, which change several times a year.

Weekly short-term fault is the weekly control zone. The zone formed by important future market marks, which change several times a year.

Monthly short-term fault is the monthly control zone. The zone, which is a reflection of the average volatility over the past year.